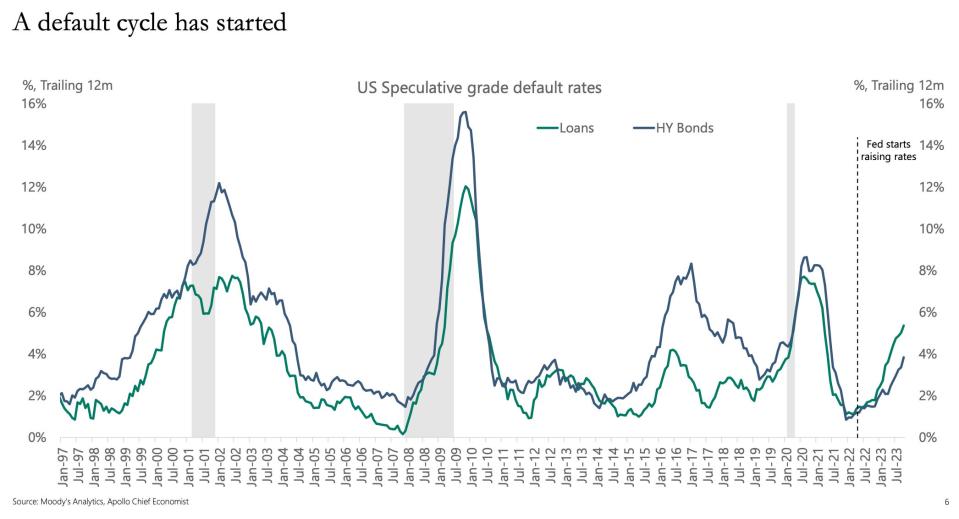

A default cycle has started, spurred by high rates and debt costs, economists at Apollo Management said.

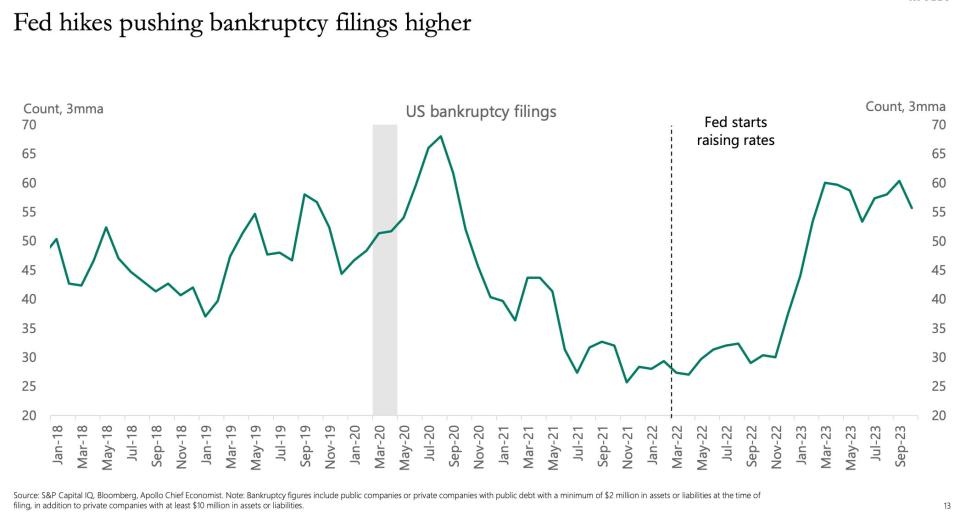

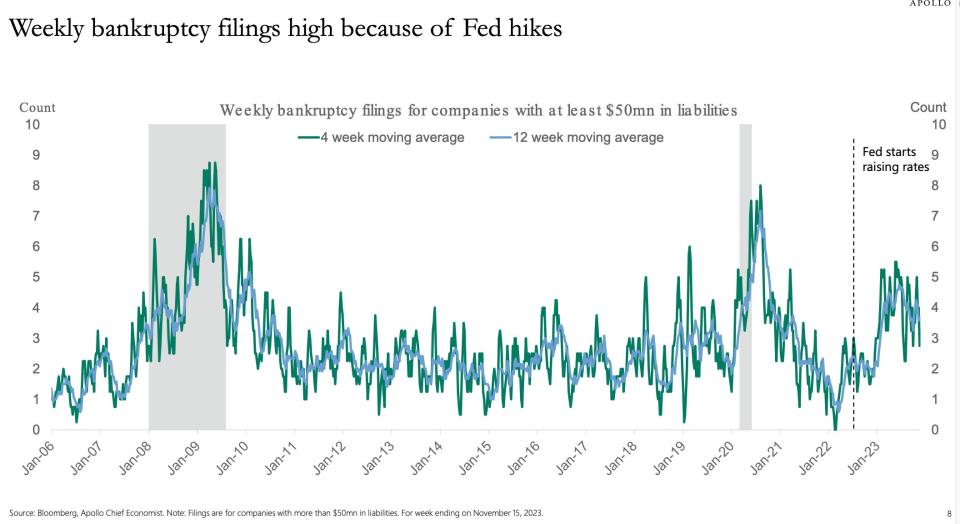

Data on default rates and bankruptcy filings show just how severe the situation is.

“It is the direct consequence of Fed hikes. The Fed is trying to slow the economy down.”

The credit market is looking at some dark clouds on the horizon as the high cost of debt is beginning to bite US companies.

According to economists at Apollo Management, those clouds are the start of a default cycle, triggered by the Fed’s hitched interest rates.

“With the Fed keeping rates higher for longer, higher debt costs will continue to weigh on earnings and interest coverage ratios over the coming quarters, and both IG and HY companies will experience higher refinancing costs,” economists led by Torsten Sløk wrote in a credit market outlook released last month.

Which is all to say that borrowing money has become too expensive for firms and a lot more of them are going to default.

“A default cycle has started with bankruptcy filings rising, and default rates will continue to rise over the coming quarters, impacting in particular middle market companies,” they added.

“The ongoing rise in default rates is not just a ‘normalization.’ It is the direct consequence of Fed hikes. The Fed is trying to slow the economy down,” Sløk wrote in an accompanying blog post.

In July, data from Moody’s showed that corporate defaults had already blown past total defaults in all of 2022 by a whopping 53%.

Meanwhile, S&P Global data has shown a cumulative 516 bankruptcy filings this year through September, which is more than in all of 2021 or 2022 and hovering just below the 518 filings in the first three quarters of 2020, when the pandemic roiled the economy.

Sløk has previously said that the Fed’s rate hikes were to blame for higher bankruptcies. And in last month’s note, he pointed out that consumers are getting pinched too.

“Lagged effects of monetary policy are slowing consumer credit growth with auto and credit card delinquencies rising and bank lending conditions tightening, leading to a significant slowing of loan growth impacting consumers and firms with weak balance sheets,” he wrote.

To be sure, high-yield bond spreads haven’t spiked, indicating the corporate bond market is “just as convinced as the stock market that the domestic economy remains solidly in growth mode,” Nicholas Colas, co-founder of DataTrek Research, said in a note in November.

Still, there is a sizeable amount of risky debt maturing in the near term, roughly 20% in the US and nearly 45% in Europe, according to Apollo.

In October, Moody’s said there was $1.87 trillion junk-rated debt maturing between 2024 and 2028 — a 27% jump from the $1.47 trillion recorded in last year’s study for 2023-2027.

This story was originally published in November 2023.

Read the original article on Business Insider

Credit: Source link