org

Mega-cap tech stocks dominated the stock market in 2023, but that could change in 2024.

Morgan Stanley told investors to expect sharp outperformance from small-cap stocks next year.

“There could be a much more sustainable relative trade away from quality and toward small caps.”

Mega-cap tech giants have dominated the stock market throughout 2023, but the torch could be passed to small-cap stocks in 2024, according to a recent note from Morgan Stanley.

A team of analysts led by Mike Wilson said that while small caps tend to underperform both before and after the Federal Reserve cuts interest rates, this time could be different.

“If the earlier than anticipated dovish shift in the context of a still healthy economic backdrop can drive a cyclical rebound in nominal growth next year, small caps likely look compelling over a longer investment horizon,” Wilson said. “In our view, the probability of this outcome has gone up recently given last week’s FOMC meeting.”

The Fed is now expected to ease monetary policy several times in 2024. Historically, that has been a negative for small-cap stocks because rate cuts are typically accompanied by an economic downturn, and smaller companies are most sensitive to macro-level ups and downs.

But with the economy in solid shape, inflation moderating, and the jobs market still strong, the Fed could be cutting rates not because of a slowdown, but because central bankers accomplished their goal of taming inflation.

That would be great news, especially for small-cap stocks, as lower interest rates should translate into a lower cost of capital, and smaller firms typically pay higher borrowing costs relative to larger companies.

To gauge whether small caps are going to outperform their larger-cap peers in 2024, Wilson recommended investors monitor earnings revisions and small-business confidence.

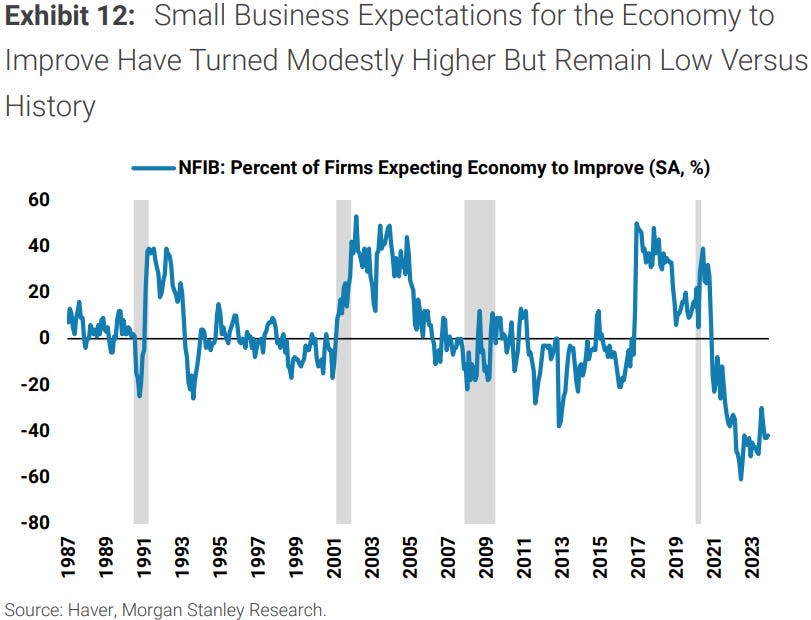

“For now, relative earnings revisions remain negative for small caps and relative margin estimates have just recently taken another turn lower,” he explained. “And small business confidence remains low in a historical context and has yet to turn convincingly higher.”

But these two indicators might finally turn higher following the Fed’s dovish pivot, which would bode well for small-cap stocks.

If that happens, “there could be a much more sustainable relative trade away from quality and toward small caps,” Wilson said.

Meanwhile, Goldman Sachs is taking the opposite side of that trade, saying in a note last month that it expects the mega-cap tech stocks to continue their streak of outperformance throughout 2024.

Read the original article on Business Insider

Credit: Source link