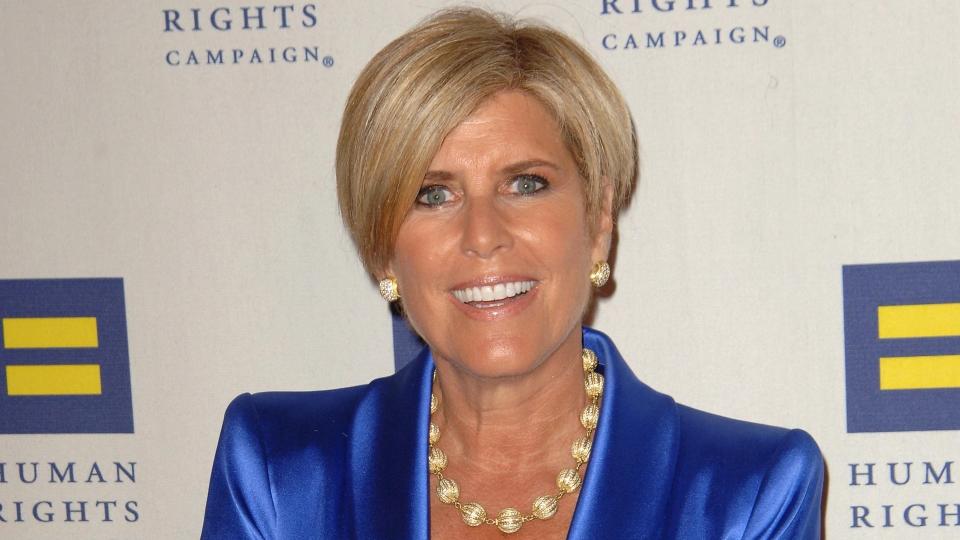

Saving for retirement might sometimes feel like a lofty goal. But according to Suze Orman, money expert and co-founder of SecureSave, it doesn’t have to be.

Find: Warren Buffett Reveals How To Invest $10,000 If You Want To Get Rich

See Our List: 100 Most Influential Money Experts

In the Dec. 11 edition of her “Money Monday with Suze Orman” newsletter on LinkedIn, Orman wrote that contributing the maximum amount to an IRA in 2024 ($7,000 for those below 50 and $8,000 for those over 50, provided that adjusted gross income qualifications are met) can “seem unobtainable.”

However, Orman — who noted that it’s smart to save in a Roth IRA because withdrawals will be 100% tax-free upon retirement — explained that the “trick is to break it down into more manageable bites.” She suggested it’s “often easier to tackle a savings goal once you convert it to smaller amounts.”

For people under 50, Orman indicated that contributing $7,000 in 2024 works out to less than $20 per day. As for people over 50? “Less than $22 a day,” she pointed out.

I’m a Financial Advisor: Here’s the No. 1 Piece of Advice I Would Give My Younger Self

Orman advised taking a “fresh tour through your monthly spending” and not necessarily seeking one big savings — as “maybe there are three to five different expenses you could cut or trim to get you to your goal.”

For instance, consider your Netflix bill. If you’re paying $15.49 for a standard package without ads, you might opt for the $6.99 standard package with ads. If you’re spending $14.99 a month on Amazon Prime but realize you’re not ordering much from the retailer, you can cancel your membership. Making those two changes would amount to saving $23.49 a month (before taxes), which you can place in your Roth IRA account.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Suze Orman: How To Maximize Your Retirement Savings With Just $20 per Day

Credit: Source link