The supply of Ether has dropped to its lowest level since the network’s historic Shanghai upgrade, with ETH’s supply now down by more than 309,500 coins since last September.

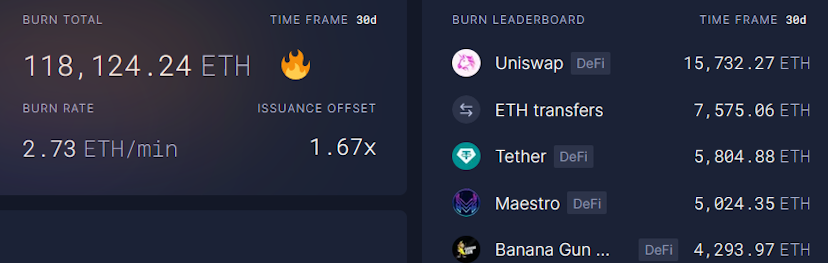

Nearly 1.195M ETH have been burned since Shanghai transitioned Ethereum to Proof of Stake consensus on Sept 15, 2022, according to data from Ultra Sound Money. The burn rate is outpacing new Ether issuance by around 30%, with the network issuing roughly 885,000 ETH as staking rewards over the same period.

ETH’s supply is now down 56,000 ETH from its local top of around 120.27M on Oct. 31 — equating to 18% of Ethereum’s post-Shanghai supply reduction over the past six weeks.

The recent acceleration in burned ETH was driven by an uptick in on-chain trading fuelled by the increasing adoption of trading bots.

Uniswap transactions comprised the single largest source of burned ETH over the past 30 days, driving around 10% of destroyed ETH.

Maestro and Banana Gun, leading public trading bots, ranked as the fourth and fifth highest burning entities on the network, burning around 5% and 4% of Ether removed from supply in the past month respectively.

Ethereum’s burn rate

The Shanghai upgrade, also known as The Merge, promised to turn Ethereum deflationary — meaning the supply of Ether drops over time — by booting Proof of Work miners from the network and revamping its tokenomics. The Merge ushered a roughly 90% reduction in new Ether issuance, meaning strong levels of on-chain activity would render the network deflationary through the burning of base transaction fees.

Ethereum quickly appeared to make good on its deflationary promise, with supply peaking at just shy of 120.534M ETH three weeks after Shanghai. The burn rate accelerated in early 2023, with ETH’s supply dropping by around 276,500 ETH from Feb. 1 and June 8.

Start for free

Although the burn rate slowed in Q3, ETH’s supply continued to drop until tagging a post-merge low of around 120.2M ETH on Aug. 31, meaning inflation had been offset by 307,370 ETH.

However, the supply of Ether flipped inflationary for the first time in 2023, with around 53,700 coins added to ETH’s supply throughout September and October. Yet Ethereum’s on-chain activity picked up again amid bullish market conditions in November, driving a sharp acceleration in Ether’s burn rate.

Credit: Source link