Overview

The electrification transition is well underway and has spurred a growth in demand for base metals, including nickel and copper, which most clean technologies require. The overall sentiment for these metals continues to be healthy and optimistic, even amid global economic turmoil.

Australia is supporting this growth in demand through its mining-friendly, tier-1 jurisdictions. The country is a world leader in producing and exporting a plethora of metals and minerals, including iron, copper, lithium, nickel, bauxite and gold. Overall, Australia produces significant amounts of 19 in-demand minerals from more than 350 operating mines. Australia’s Musgrave Province contains a Mesoproterozoic crystalline basement terrain that reaches across the shared borders of Western Australia, the Northern Territory and South Australia. The terrain has significant deposits of several essential metals, including nickel, platinum group elements (PGEs), copper, gold, lead, zinc, chromite, and rare earth elements (REEs). Yet, much of Musgrave remains underexplored, especially for the base metals the world now needs.

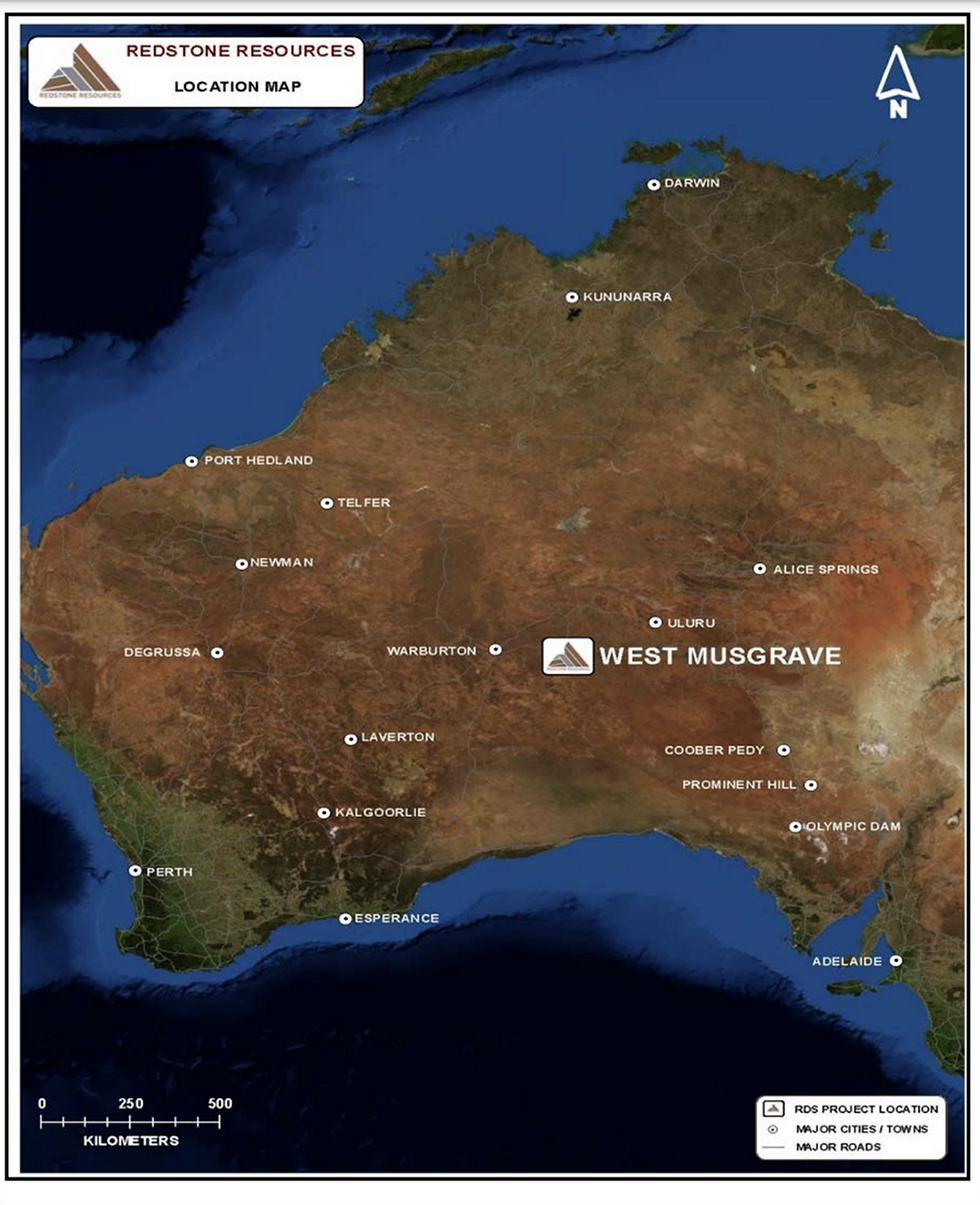

Redstone Resources (ASX:RDS) is a base and precious metals exploration company, exploring its 100-percent-owned, highly prospective West Musgrave Project, which includes the Tollu Copper deposit, located in the West Musgrave Province of Western Australia. The company’s West Musgrave Project is located proximal to BHP’s world-class Nebo-Babel nickel-copper-PGE sulphide deposit and Succoth copper (nickel, palladium) deposit, and Nico Resources’ Wingellina nickel-cobalt project. Redstone also has other pending tenement applications prospective for nickel and copper in the same region. The company is led by a management team with expertise in geology and mineral exploration, business development and corporate law, creating confidence in the team’s ability to capitalize on its assets.

The unique Musgrave terrain has already drawn the interest of notable miners, such as OZ Minerals, now owned by BHP. BHP is progressing with the development of its Nebo-Babel nickel-copper-PGE sulphide deposit, which has been estimated to have a resource of 390 million tonnes grading 0.33 percent copper and 0.30 percent nickel, for 1.2 million tonnes of contained nickel metal and 1.3 million tonnes of contained copper metal (Mea + Ind + Inf – 2012 JORC). Final regulatory approval to begin construction of the Nebo-Babel mine has been granted. Other discoveries and deposits in the area, such as the Wingellina nickel-cobalt deposit, indicate the potential of the West Musgrave region to become a significant base metal jurisdiction.

Redstone’s flagship, 100-percent-owned West Musgrave Project is situated between these two deposits — approximately 40 kilometers east of BHP’s Nebo Babel nickel-copper-PGE deposit and 50 kilometers west-southwest of Nico Resources’ Wingellina nickel-cobalt deposit. Redstone’s West Musgrave Project is highly prospective yet largely underexplored. The asset has the right geological and structural setting for large magmatic nickel-copper sulphide deposits, volcanic-hosted massive sulphide (VHMS) deposits and other large intrusive related hydrothermal systems.

Location of Redstone’s West Musgrave Project, which includes the Tollu copper deposit, in relation to the world-class Nebo-Babel Ni-Cu-PGE deposit.

The 100-percent-owned Tollu Copper Vein deposit, located within the West Musgrave Project, has a JORC-compliant indicated and inferred resource estimate of 3.8 million tonnes grading 1 percent copper, for 38,000 tonnes of contained copper with a cut-off of 0.2 percent. There is also a current estimated conceptual exploration target*, which suggests a potential for up to 627,000 tonnes of copper at Tollu. (*conceptual exploration target ranges from 31 to 47 million tonnes of mineralization at 0.8 to 1.3 percent copper, containing 259,000 to 627,000 tonnes copper.)

Redstone Resources also entered into a joint venture agreement with Galan Lithium (ASX:GLN) to acquire 100 percent of the highly prospective suite of lithium projects that include Camaro, Taiga and Hellcat in the James Bay Lithium Province in Quebec. Redstone will be the manager of the joint venture which covers 5,187 hectares of tenure. The joint venture also secured an option to acquire 100 percent of the PAK East and PAK Southeast Lithium Projects composed of 1,415 hectares in Ontario’s Electric Avenue near Frontier Lithium’s (Frontier) PAK Lithium Project.

An experienced management team leads Redstone with decades of experience in the mineral resources sector, with expertise in mineral exploration, mining operations and corporate finance.

Company Highlights

- Redstone Resources is an Australia-based mineral exploration company exploring highly prospective properties for copper and nickel in the West Musgrave region of Western Australia.

- The West Musgrave region has already drawn the interest of miners who have made significant discoveries, including the world-class Nebo-Babel nickel-copper-PGE sulphide deposit and the Wingellina nickel-cobalt deposit.

- Redstone’s projects are in close proximity to these existing projects, indicating the potential of the company’s tenure.

- The company owns 100 percent of the West Musgrave Project, which includes the Tollu Copper vein deposit.

- It has the right geological and structural setting for large magmatic nickel-copper sulphide deposits, VHMS deposits and other large intrusive-related hydrothermal systems

- The Tollu Copper vein deposit is proof of a significant hydrothermal system in the project area.

- The company has also recently entered into an agreement to acquire a 100-percent interest in the Attwood Lake Area Lithium properties, located in northwestern Ontario, Canada, known to be highly prospective for lithium and rare element pegmatites, and in close proximity to several advanced lithium projects.

- The Attwood Project acquisition complements the company’s West Musgrave copper-nickel project and its strategy to increase exposure to the growing global battery metals and explore for critical minerals in high demand.

- Redstone Resources entered into a joint venture agreement with Galan Lithium (ASX:GLN) to acquire 100 percent of highly prospective suite of lithium projects in Quebec and Ontario.

- A strong management team leads the company with decades of experience in the resources sector.

Key Projects

The West Musgrave Project

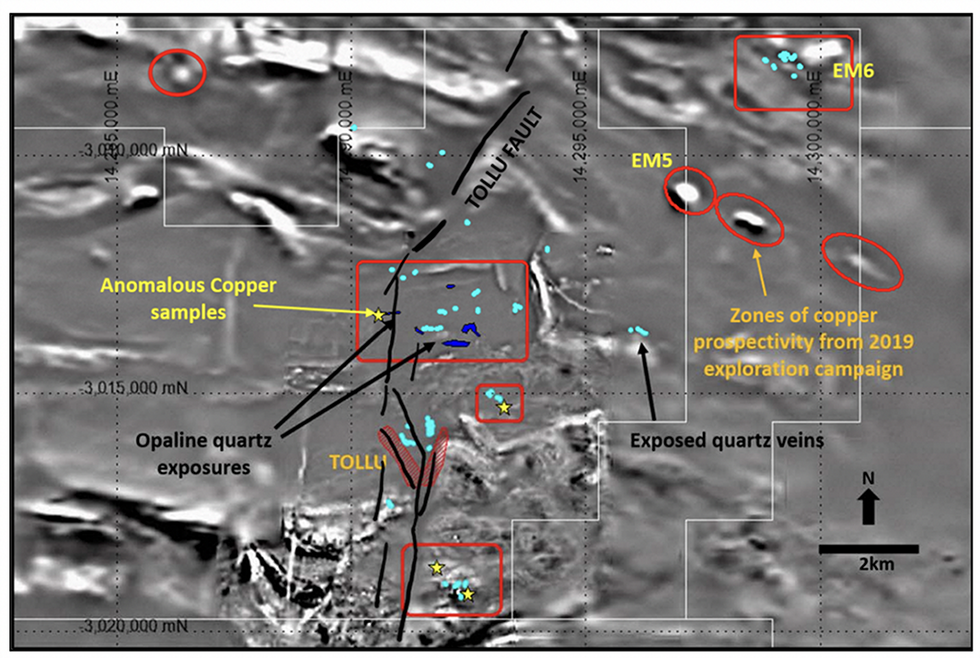

The West Musgrave Project covers 237 square kilometers of highly prospective yet underexplored terrain. The asset is 40 kilometers east of the world-class Nebo- Babel nickel-copper-PGE sulphide deposit owned by BHP’s OZ Minerals, and contains suitable geological structure and settings for nickel-copper deposits. Redstone plans to continue the exploration of the asset to follow up on recent drilling and exploration results which identified numerous prospective targets.

Project Highlights:

- Promising Geological Setting: The project hosts the right geological and structural setting for large magmatic nickel-copper sulphide deposits, VHMS deposits, and other large intrusive related hydrothermal mineralizing systems.

- Excellent Exploration Results to Date:

- The 2022 RC drill campaign conducted at the West Musgrave project returned with the highest copper grade ever to be encountered at the project, with a 1 meter intersection at 18.5 percent copper from only 18 meters downhole at the Forio Prospect.

- The latest RC drilling also confirmed the presence of mafic-ultramafic nickel source target rocks at West Musgrave – drill holes TLC183 and TLC196 have intersected a Hi-Mg mafic-ultramafic intrusion with elevated nickel and chromium at the West Cigar Magnetic Target, some 7.5 kilometers northeast of the Tollu Copper Deposit.

- This is the first time potential host or source rocks for nickel, copper, cobalt and platinum group elements (PGE) have been intersected on the project, which is significant considering the western boundary of the project area is only 40 kilometers east of BHP’s (ASX: BHP) Nebo-Babel nickel-copper-cobalt-PGE deposit.

- Additional Exploration Recently Completed: Further results remain pending for the 2022 second-phase RC drilling program.

- Significant Exploration Upside: Drilling to date has focused on less than 10 percent of the project – primarily around the exposed copper veins at Tollu.

Location of the anomalous copper samples (yellow stars) and the new target areas of prospectivity (red boundaries) identified by the recent exploration campaign (geological mapping and drilling). Opaline quartz is mapped in dark blue and quartz vein outcrops are mapped in light blue.

The Tollu Copper Vein Project

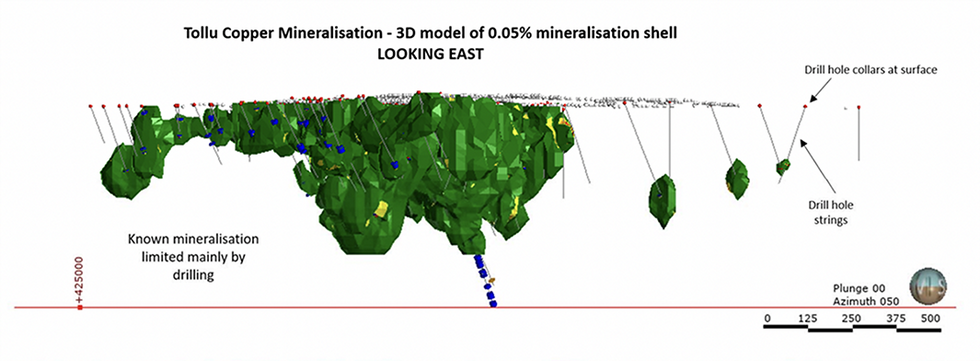

Redstone’s Tollu Copper Vein deposit is located within the broader West Musgrave Project and has already produced promising drilling results. Tollu hosts a giant swarm of hydrothermal copper-rich veins in a mineralized system covering an area of at least 5 square kilometers. Copper mineralization is exposed at the surface and forms part of a dilation system within and between two major shears.

Redstone has defined a JORC 2012 resource estimate for Tollu of 3.8 million tonnes grading 1 percent copper, for 38,000 tonnes of contained copper and 0.01 percent cobalt, which equates to 535 tonnes of contained cobalt, however, the company considers that this estimate may be far greater with further drilling.

Project Highlights:

- Tollu Resource Estimate: The Tollu Copper Vein deposit has a JORC-compliant resource estimate of 3.8 million tonnes grading at 1 percent copper for 38,000 tonnes of contained copper.

- Conceptual Exploration Target* May Expand Resource Estimate: A conceptual exploration target has been estimated on the Tollu Copper Vein system which suggests a potential of 627,000 tonnes of additional copper.

- Opportunities for Resource Expansion: The 38,000-tonne copper resource may be far greater with further drilling, and continued drilling at Tollu highlights opportunities for extensions of the thick high-grade copper mineralization intersected in historical drill holes, including towards shallower depth, and consequently potential opportunities to expand the Tollu resource. Drilling results from 2017 to present are not yet included in the current Tollu resource. Additionally, the source of the Tollu copper has not yet been adequately tested at depth.

- Significant Historical High-Grade Copper Results – near surface and at depth: Significant high-grade copper has been intersected at Tollu from near surface to up to 434 meters deep including with grades as high as 3.25 percent copper over 14 meters (from 25 meters depth) (TLC153) at the Forio prospect, and 10 meters at 3.4 percent copper from 424 meters deep and still open, including 5 meters at 5.3 percent copper from 427 meters deep (TLC80) at the Chatsworth prospect.

- Recent Drilling Continues High-grade Results:

- Recent drilling at Chatsworth has extended the vertical continuity of the copper mineralization in some of the historical drill holes to double that previous with at least some 100 meters of the vertical extent and open at depth and towards the surface.

- The significant, late 2021 high-grade copper intersections drilled at Chatsworth include:

- 10 meters at 2.51 percent copper from 174 meters downhole (TLC188) including:

- 3 meters at 4.71 percent copper from 175 meters downhole;

- 26 meters at 1.46 percent copper from 61 meters downhole (TLC189) including:

- 1 meter at 5.1 percent copper from 84 meters downhole;

- 16 meters at 2.88 percent copper from 74 meters downhole (TLC190) including:

- 9 meters at 4.6 percent copper from 76 meters downhole, which includes

- 2 meters at 7.62 percent copper from 76 meters downhole;

- 22 meters at 1.26 percent copper from 104 meters downhole (TLC190) including:

- 3 meters at 3.67 percent copper from 122 meters downhole; and

- 25 meters at 1.10 percent copper from 53 meters downhole (TLC192) including:

- 7 meters at 2.64 percent copper from 60 meters downhole.

- Late 2021 drilling at Forio continued the high-grade drilling results at this prospect with a single 34-meter intersection grading 1.07 percent copper from only 15 meters depth downhole (TLC181) including:

- 2 meters at 3.21 percent copper from 19 meters downhole;

- 1 meter at 2.48 percent copper from 28 meters downhole;

- 1 meter at 1.99 percent copper from 35 meters downhole; and

- 1 meter at 2.52 percent from 40 meters downhole

- Geochemical assays from the late 2022 RC drilling campaign have confirmed the highest copper grade ever intersected at Tollu with 1 meter @ 18.5 percent copper from 18 meters downhole (TLC203). The further significant high- grade copper mineralization intersections at Forio include:

- 8 meters at 4.1 percent copper from 13 meters downhole depth in drill hole TLC203, including 1 meter at 18.5 percent copper from 18 meters downhole;

- 4 meters at 1.2 percent copper from 45 meters downhole in drill hole TLC203; and

- 6 meters at 1.47 percent copper from 80 meters downhole in drill hole TLC201.

- The high-grade copper intersections in drill holes TLC201 and TLC203 extend Forio’s high-grade copper mineralization zone to a 60-meter strike length (north and south) of continuous high-grade copper.

- The recent Forio drilling has shown that thick high-grade copper lenses have the potential to extend over significant distances along strike and to depth.

- Simple Oxide Copper Opportunity: The significant intersections of Tollu mineralization up to the surface supports investigation of a simple oxide copper resource opportunity – the Tollu drilling from 2017 to date suggests a potential for an increase from 8,000 tonnes of oxide copper already defined in the Tollu resource.

Board and Management

Richard Homsany – Non-executive Chairman

Richard Homsany is executive vice-president of Mega Uranium Ltd, a Toronto Stock Exchange listed company and executive chairman of Toro Energy Limited, an ASX listed uranium company. He is also currently the non-executive chairman of Galan Lithium Ltd and the Health Insurance Fund of Australia Limited.

Prior to this Homsany was a corporate and commercial advisory partner with one of Australia’s leading law firms. He is currently the principal of Cardinals Lawyers and Consultants and has been admitted as a solicitor for over 20 years. Homsany has extensive experience in corporate law, including advising public resources and energy companies on corporate governance, finance, capital raisings, takeovers, mergers, acquisitions, joint ventures and divestments.

He also has significant board experience with publicly listed resource companies and in the resources industry. He has also worked for an ASX top 50-listed internationally diversified resources company in operations, risk management and corporate.

Homsany is a certified practicing accountant and is a fellow of the Financial Services Institute of Australasia (FINSIA). He has a commerce degree and honors degree in law from the University of Western Australia and a graduate diploma in finance and investment from FINSIA.

Brett Hodgins – Technical Director

Brett Hodgins has over 20 years of professional experience in the resources sector primarily focused on exploration and mining operations. He began his career as a geologist with Robe River Mining and Rio Tinto Iron Ore. During that time he was involved with the commissioning and development of the West Angelas and Hope Downs operations. Hodgins’ recent roles include general manager project development for Iron Ore Holdings and he is president/CEO of Central Iron Ore Ltd, a TSXV listed company gold and iron ore explorer. He brings a wide range of experience in exploration, feasibility studies, operations, and has a broad knowledge of the resource sector.

Hodgins has completed a bachelor of science degree with honors in geology from Newcastle University, diploma of management and a graduate diploma in finance and investment from FINSIA.

Edward van Heemst – Non-executive Director

Edward van Heemst is a prominent Perth businessman with over 40 years of experience in the management of a diverse range of activities with large private companies.

He is the managing director of Vanguard Press and was previously the long-time chairman of Perth Racing (1997 to 2016). He was also appointed as non-executive chairman of NTM Gold Ltd, an ASX-listed company from July 2019 to March 2021.

Van Heemst holds a bachelor of commerce degree from the University of Melbourne, an MBA from the University of Western Australia and is a member of the Institute of Chartered Accountants Australia.

He has extensive knowledge of capital markets and established mining industry networks.

Dr. Greg Shirtliff – Geological Consultant

Dr. Greg Shirtliff has over 20 years’ experience in industry-related geology and geochemistry, including a PhD in mine-related geology from the Australian National University. Since his studies, Shirtliff has spent over 17 years in various roles in the mining and exploration industry ranging from environmental, mine geology, resource development, exploration and management roles, exploration and technical projects inclusive of engineering and metallurgical. His roles have included a number of years at ERA-Rio Tinto’s Ranger Uranium Mine, as the senior geoscientist for Cameco Australasia and more recently as the lead geologist and technical manager for Toro Energy Ltd, an ASX-listed uranium development company in Australia where he is the exploration and technical lead responsible for increasing the viability of the company’s uranium and mineral resources, developing and directing the company’s uranium and non-uranium exploration strategy, aiding the company technically through EPA approval for a uranium, and guiding the engineering and metallurgical through to scoping level economic assessment.

Shirtliff has had recent exploration success at Toro Energy, discovering multiple zones of massive nickel sulphide mineralization along the Dusty Komatiite, arguably the first massive nickel sulphide mineralization discovered in the Yandal Greenstone Belt in Western Australia.

Shirtliff holds directorships on privately owned consultancy and prospecting companies.

Shirtliff is a long-standing member of the Australian Institute of Mining and Metallurgy and the internationally recognized Society of Economic Geologists.

Credit: Source link