The total market potential of hydrogen technology could reach $11 trillion by 2050, with major advancements and falling production costs, says Bank of America, which firmly believes “we are reaching the point of harnessing the element that comprises 90% of the universe, effectively and economically”.

This year, in particular, has seen major momentum …

Germany and Norway have agreed to build a hydrogen pipeline as a replacement for Russian natural gas and coal.

Australia’s hydrogen project pipeline is one of the biggest in the world, with 12 million tons per annum–the bulk of which is green, or clean, hydrogen, according to Wood Mackenzie.

In the U.S., McKinsey sees potential for the Gulf Coast–led by Houston–to become the world’s leading clean-hydrogen hub by 2030. Hydrogen could be far bigger than LNG, even. Texas alone, could see demand for hydrogen top 21 million tons per annum by 2050.

“The effect would be significant: a clean-hydrogen hub could possibly generate around $100 billion in additional GDP by 2050 for Texas,” McKinsey says.

Washington is also pouring money into hydrogen projects.

The catalysts are lining up with phenomenal momentum, and there is a logical reason for this:

Of all our climate change efforts, JP Morgan says hydrogen will be the “pivotal” source of energy over the coming decades, with both nuclear fusion and carbon capture, utilization and storage (CCUS) “unlikely to have a significant impact prior to 2030.

Now, with all eyes on the real innovators here, a high-tech hydrogen breakthrough by privately-held GH Power opens another door in this burgeoning $ 11 trillion industry that’s created a hydrogen bull market.

Reactor Hydrogen for North America

North America is desperate for hydrogen breakthroughs, and GH Power’s new renewable energy technology is one of the latest. The technology uses exothermic reactions with only two inputs (end of life or recycled aluminum and water) to create three extremely valuable green outputs: hydrogen, alumina (aluminum oxide), and exothermic heat.

The process uses recycled scrap aluminum as the key input. That aluminum is then mixed with water through a proprietary reactor designed to continuously operate to produce hydrogen, alumina, and exothermic heat (power) with zero emissions, zero carbon, and zero waste. That earns it a Carbon Intensity Score of -39 ( Based upon 3rd Party Report).

The reactors are scalable and modular, which means they can be designed and built for small or scalable large power requirements with last-mile delivery. This advanced technology is simple to permit, build, operate and integrate with other industrial processes, even in remote areas.

The reactor plant’s environmental footprint is extremely light: Each plant can fit up to 27 megawatts of green energy into a space that occupies only 2,000 square meters.

GH Power is planning to develop a plant which produces 11,700 Tonnes of green hydrogen per year to fuel a 30-MW combined cycle plant with a net output of 27 MW.

Led by world-class engineers with over 100 years of combined experience operating power plants, refineries, and other energy infrastructure, GH Power’s 2MW demonstration commercial reactor will start generating revenues in the second quarter of next year, and this is only the beginning. GH Power has a pipeline with blue-chip strategic partners to build out large-scale hydrogen power plants in North America and Europe.

Its technology has won it global recognition, with a green technology grant in partnership with Germany’s RWTH Aachen University, sponsored by the Canadian and German governments.

Finally, Low-Cost Hydrogen

GH Power’s reactor is self-sustaining, zero emission, and is a net producer of energy for consumption.

Most importantly, it’s a North American first: It’s cost-competitive with conventional fossil fuels.

And the reactor’s value extends far further than this …

It process also produces green hydrogen, exothermic heat, and green alumina, which has numerous commercial applications used for everything from lithium-ion batteries and LED lighting to semiconductor production.

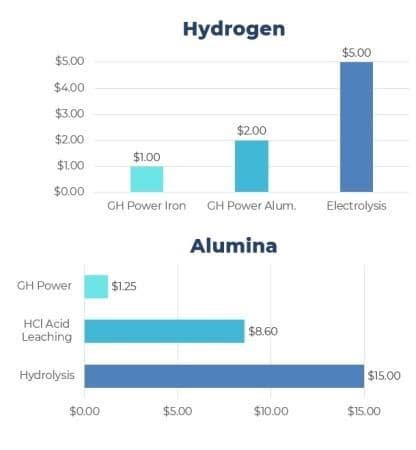

Green hydrogen produced from electrolysis costs about 3X more than hydrogen produced from natural gas, with the U.S. Department of Energy averaging green hydrogen at about $5 per kilogram. The enormous amount of money pouring into green hydrogen right now is intended to bring the cost down by 80% to $1 per kilogram within 10 years.

So not only does GH Power say its reactor is already 60% cheaper than producing hydrogen by the currently most common method of electrolysis, but it’s also producing two other valuable green outputs for the market: exothermic heat that can be put back on the grid, and green alumina.

The green alumina output is produced 85% cheaper than existing production processes of hydrochloric acid leaching and hydrolysis.

GH Power’s technology is producing green hydrogen for 60% less than the current dominating process, thanks to its proprietary technology, which relies on only two inputs, water, and recycled aluminum, which is widely available everywhere for as little as $1.50/kg.

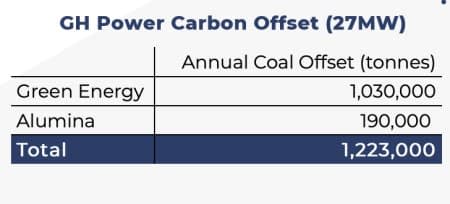

GH Power’s reactor also produces green alumina for 85% less, it’s also going to play a role in decarbonization. The 27MW plant could produce 1.2 million tonnes of carbon offset every year.

That’s a huge amount of carbon offset revenue potential considering that 1 metric ton of carbon offset costs between $40 and $80.

Flipping The Switch On The First Reactor

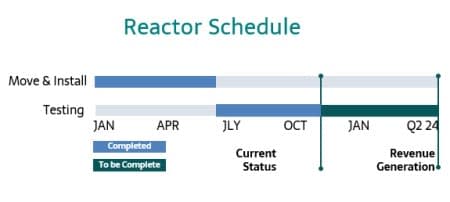

Phase 1 testing at GH Power’s first reactor in Hamilton, Ontario, has been completed, and Phase 2 testing was launched in late June. Phase 2 testing is preparation for commercial operations, which expect to be generating revenues by the second quarter of next year.

Phase 3 moves to continuous operations of the 2MW reactor and integration into the final modular reactor design for a large-scale solution. 2MW Reactor Schedule is shown below:

The faces behind this green hydrogen breakthrough are major forces in the energy industry, led by CEO Dave White, a veteran engineer, and Chief Engineer Ken Stewart who has designed and managed thermal power plant and petrochemical processes across North America. COO Gary Grahn also has 25 years of international energy experience including in oil, gas, minerals, metals and utilities, CFO Anand Patel contributes a decade of real asset capital markets experience, with over $4 billion in completed transactions, including for renewable energy giant Brookfield Asset Management, and Development Director Mike Miller is a former NextEra Energy figure with decades of infrastructure and private equity experience.

Together, they are releasing a breakthrough into a world starved for progress in the energy transition–progress that hydrogen is best suited to make. Other companies in the hydrogen space that might be worth looking into from an investment perspective:

Air Products and Chemicals, Inc. (NYSE:APD) is a well-established name in the industrial gas sector, now making significant strides in the hydrogen market. Their move into creating integrated hydrogen systems shows their adaptability and forward-thinking approach. They’re not just looking at producing hydrogen; they’re envisioning a sustainable energy ecosystem.

Their extensive experience provides a competitive edge. Few companies can boast expertise in both production and distribution of industrial gases. With hydrogen set to play a major role in future energy scenarios, their comprehensive solutions offer both reliability and scalability, essential in today’s rapidly evolving energy landscape.

Investing in Air Products and Chemicals means backing a company with a strong heritage and a clear vision for the future. As the global focus shifts towards hydrogen, their end-to-end approach to hydrogen technology makes them a compelling narrative in the hydrogen story and a potentially lucrative choice for investors.

Ballard Power Systems Inc. (NASDAQ:BLDP) is a pioneer in the fuel cell industry, especially known for their advanced proton exchange membrane (PEM) technology. They’re making a significant impact in various transportation sectors, including buses and trains. This puts Ballard at the forefront, not just as a producer but as a major influencer in the green transportation movement.

The company’s influence and technological advancements offer great potential for growth, especially as the world is increasingly focusing on sustainable energy and cleaner transportation methods. Investors looking at Ballard will see a company that’s not just following trends but setting them up, which could lead to an increase in demand for their technology.

Ballard’s broader vision and commitment to sustainability align well with global environmental goals. This makes them a compelling choice for investors who are looking to support a company that’s driving change in the industry and helping to shape a more sustainable future.

Linde plc (NYSE:LIN), with its rich history in the industrial gas domain, is making commendable strides in the hydrogen space. Their holistic approach encompasses every aspect of hydrogen, from production to infrastructure. This deep commitment demonstrates their genuine dedication to advancing hydrogen technology.

Their global presence gives them a distinct advantage. Linde isn’t just producing hydrogen; they’re actively setting up infrastructure, partnering on various projects, and engaging in research and development to further enhance their capabilities. This proactive stance in the hydrogen revolution sets them apart from competitors.

For investors, Linde offers a blend of stability and innovation. Their extensive experience, combined with a proactive approach to hydrogen technology, suggests steady growth and visionary leadership in the industry. Linde represents a balanced investment option in a market that values both historical success and future-oriented innovation.

Cummins Inc. (NYSE:CMI) is widely known for its engines and power solutions, but its venture into hydrogen technology illustrates its adaptability and forward-thinking mindset. They’re not just adding a new line of products; they’re reimagining the future of transportation and power. This blending of traditional strengths with innovative hydrogen solutions positions them uniquely in the market.

Cummins’ hybrid approach, combining their established product range with new hydrogen technologies, sets them apart as a versatile energy provider. This strategy suggests they’re not only catering to current market needs but also preparing for future energy demands. Such a comprehensive approach is attractive to investors looking for a blend of stability and innovation.

For investors, Cummins represents a legacy brand that’s continuously evolving. This combination of stability, innovation, and growth potential makes Cummins an appealing option for those seeking a reliable yet progressive investment in the energy sector.

Shell’s (NYSE:SHEL) transition from a traditional oil major to a diversified energy company is a significant narrative in the energy sector. Their foray into hydrogen initiatives is a key part of this transformation, reflecting a broader shift towards sustainability and innovation. Shell’s involvement in hydrogen ranges from establishing refueling stations to engaging in research collaborations, showcasing a comprehensive and forward-thinking strategy.

For investors, Shell presents a unique opportunity that combines the stability of an established energy giant with the agility of a green technology firm. Their commitment to hydrogen is an integral part of their future roadmap, indicating a strategic pivot towards renewable energy sources.

Investing in Shell means backing a company that’s not only adapting to the changing energy landscape but is also at the forefront of driving that change. The dual advantage of robustness and forward-thinking innovation makes Shell an attractive investment choice in a fluctuating energy market.

BP (NYSE:BP), formerly known as British Petroleum, symbolizes its transformation through its rebranding to ‘Beyond Petroleum’. This shift marks their evolution from a traditional energy company to a leader in the green energy revolution, with hydrogen being a key area of focus. Their involvement in hydrogen, through various investments and partnerships, underscores a progressive mindset.

BP’s positioning of hydrogen as a cornerstone of their future growth strategy aligns with global sustainability goals. Their commitment to this sector is a strong indication of their long-term growth potential and readiness to play a significant role in the future energy landscape.

Plug Power Inc. (NASDAQ:PLUG) is carving a unique path in the green energy sector with their innovative hydrogen fuel cell systems. Their focus is on replacing conventional batteries, marking a significant shift in energy storage and application. This positions them not just as a product developer but as a visionary in redefining the energy value chain.

Their ambition extends beyond mere product development. Plug Power aims to transform how industries approach power and sustainability. This comprehensive vision suggests a long-term strategic plan, making them an attractive choice for forward-thinking investors. They’re not just following the trend; they’re aiming to lead it.

Plug Power’s commitment to a sustainable energy future places them at a critical juncture in the hydrogen space. As industries globally transition towards greener energy solutions, the demand for Plug Power’s innovative and trailblazing technology is expected to grow, making them a key player to watch.

Bloom Energy Corporation (NYSE:BE) is redefining the fuel cell landscape with their advanced solid oxide fuel cells. These products are primarily designed for on-site electricity generation, addressing the inefficiencies associated with centralized energy distribution. Bloom’s vision of decentralized power generation is increasingly relevant in today’s world, where energy security and efficiency are top priorities.

Bloom Energy is more than just a technology company; it represents a forward-looking approach to energy. Their focus on technological advancement and responsiveness to market needs makes them a key player in the renewable energy sector. This innovative approach is particularly attractive in an era that demands both innovation and practical solutions.

For investors, Bloom offers a glimpse into the future of energy. Their commitment to redefining power generation positions them as a promising option in the renewable energy market, offering both innovative solutions and timely responses to current energy challenges.

FuelCell Energy Inc. (NASDAQ:FCEL) stands out as a key player in the stationary fuel cell power plant market. Their focus on distributed power generation addresses the critical need for decentralized, efficient energy sources. The company’s solutions are designed with a unique blend of commercial viability and environmental responsibility.

From an investment perspective, FuelCell Energy offers a balanced opportunity that caters to both current market demands and future growth potential. Their commitment to reducing emissions while enhancing energy efficiency resonates with the global shift towards sustainability, positioning them well in the market.

The company’s dedication to innovation and environmental stewardship makes it an attractive option for investors. With the increasing demand for sustainable and profitable energy solutions, FuelCell Energy’s approach positions them as a company with both immediate relevance and long-term potential.

By. Josh Owens

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the governments are funding development of hydrogen technologies; that significant funds are being invested in clean hydrogen producers; that governments are aiming to help develop carbon-free clean hydrogen solutions; that hydrogen power will be utilized as a main driver for decarbonization and as a source of energy for the global economy in the future. replacing fossil fuels and other competing alternative technologies in the future; that GH Power Inc.’s technology will be developed, commercially implemented and achieve widespread market acceptance; that GH Power will complete the development of its hydrogen reactor that will produce hydrogen 60% cheaper than by electrolysis, become a net producer of energy to the supply grid, co-produce alumina which is 85% cheaper than current production methods; that GH Power’s technology will be revolutionary in the decarbonization of the energy sector; that GH Power’s small pilot model will be scalable at the commercial level in the proposed reactor in Hamilton, Ontario, and will achieve the anticipated results of clean, carbon-free energy production and related bi-products; that GH Power can finance ongoing operations and development; that GH Power can achieve its business plans and objectives as anticipated. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition including that governments may fund the development of alternative technologies instead of hydrogen based technologies; that hydrogen technology may fail to gain widespread commercial use and acceptance due to safety, cost or other issues; that alternative technologies may be preferred in the future to hydrogen technologies as the main replacement of fossil fuels and other energy sources; that GH Power Inc.’s technology may fail to be completely or successfully developed and/or commercially implemented; that alternative technologies may gain wider acceptance than or prove to be superior to those of GH Power for various reasons; that alternative technologies may result in greater energy savings and necessary bi-products; that GH Power’s technology may fail to deliver the results anticipated in a commercial setting; that GH Power’s commercial reactor may not be developed as anticipated or at all; that GH Power may be unable to finance its ongoing operations and development; that the business of GH Power may be unsuccessful or otherwise fail for various reasons. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by GH Power Inc. for this article. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct. The content of this article is based solely on our opinions which are based on very limited analysis and we are not professional analysts or advisors.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of GH Power Inc. and therefore has an incentive to see the featured company perform well if its securities becomes listed on a stock exchange. If the securities of GH Power become listed on a stock exchange, the owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of GH Power Inc. in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we are biased in our views and opinions in this article and why we stress that you should conduct your own extensive due diligence and research regarding the Company as well as seek the advice of your qualified professional financial advisor or a registered broker-dealer before you consider investing in any securities of the company profiled in this article or otherwise.

NOT AN INVESTMENT ADVISOR. Oilprice.com is not qualified, registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendations.

ALWAYS DO YOUR OWN RESEARCH and consult with a qualified and licensed investment professional before making any investment. This communication should not be used as a basis for making any investment in any securities.

RISK OF INVESTING. Investing is inherently very risky. Don’t invest or trade with money you can’t afford to lose. This is neither a solicitation nor an offer to invest in or buy/sell securities. No representation is being made that any stock investment, acquisition or disposition will or is ever likely to achieve profits.

Read this article on OilPrice.com

Credit: Source link