In a notable insider transaction, Keith Yandell, the Chief Business Officer of DoorDash Inc (NASDAQ:DASH), sold 9,171 shares of the company on November 20, 2023. This move has caught the attention of investors and market analysts, as insider sales can provide valuable insights into a company’s internal perspective on its stock’s value and future prospects.

Who is Keith Yandell?

Keith Yandell plays a significant role at DoorDash Inc as the Chief Business Officer. His responsibilities include overseeing the company’s business operations, legal matters, and strategic business initiatives. Yandell’s background includes a wealth of experience in the technology and legal sectors, making him a key figure in DoorDash’s executive team. His decisions, especially regarding stock transactions, are closely watched by investors for indications of the company’s health and trajectory.

DoorDash Inc’s Business Description

DoorDash Inc is a technology company that operates a logistics platform connecting customers with their favorite local and national businesses in the United States and internationally. The platform empowers merchants to grow their businesses by offering on-demand delivery, data-driven insights, and better in-store efficiency, providing consumers with a convenient and time-saving way to get what they need. DoorDash’s innovative approach to on-demand delivery has positioned it as a leader in the food delivery industry, with a growing footprint in other categories such as grocery and retail goods.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, particularly sales, can be a double-edged sword when it comes to interpreting their impact on a company’s stock price. On one hand, insiders may sell shares for personal financial planning reasons that have no direct correlation with their outlook on the company’s future. On the other hand, large or frequent sales by insiders might signal a lack of confidence in the company’s upcoming performance or valuation.

Looking at Keith Yandell’s trading history, the insider has sold a total of 63,381 shares over the past year without purchasing any shares. This one-sided activity could raise questions among investors about Yandell’s long-term confidence in DoorDash’s stock. However, without additional context, it is challenging to draw definitive conclusions from these transactions alone.

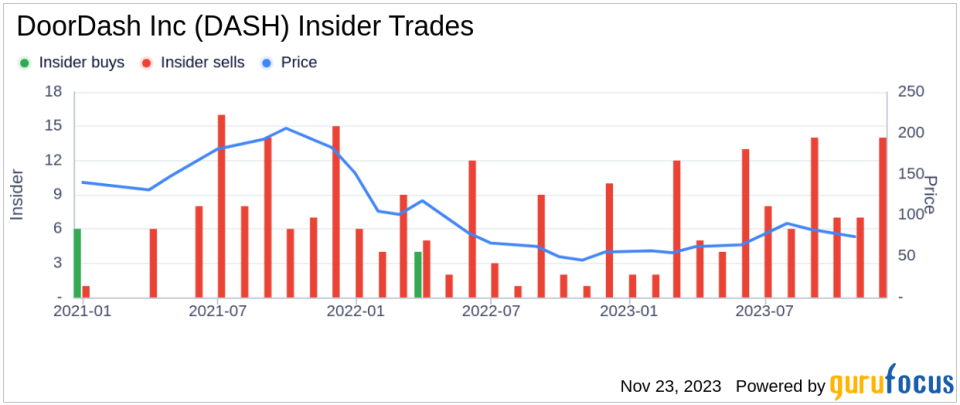

When examining the broader insider trends at DoorDash Inc, we observe that there have been no insider buys and 94 insider sells over the past year. This pattern of behavior could suggest that insiders, on the whole, believe the stock may be fully valued or that they are taking profits after periods of stock appreciation.

On the valuation front, DoorDash Inc’s shares were trading at $95.11 on the day of Yandell’s recent sale, with a market cap of $37.969 billion. This price point is below the GuruFocus Value (GF Value) of $107.19, indicating that the stock is modestly undervalued with a price-to-GF-Value ratio of 0.89. The GF Value is a proprietary metric that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

Despite the insider selling trend, the GF Value suggests that DoorDash’s stock might be an attractive buy for value investors. However, potential investors should consider the insider selling activity as part of a broader analysis, including the company’s growth prospects, competitive position, and overall market conditions.

The insider trend image above provides a visual representation of the selling pattern, which could be interpreted as a cautious signal by market participants.

The GF Value image further illustrates the current valuation of DoorDash Inc relative to its intrinsic value estimate, as calculated by GuruFocus.

Conclusion

Keith Yandell’s recent sale of 9,171 shares of DoorDash Inc is a transaction that warrants attention from investors. While the company’s stock appears modestly undervalued based on the GF Value, the consistent pattern of insider selling over the past year may raise concerns. Investors should weigh these insider activities alongside other fundamental and technical analyses to make informed decisions about their investments in DoorDash Inc.

As always, it is important to remember that insider transactions are just one piece of the puzzle when evaluating a stock’s potential. A comprehensive approach that includes an examination of financial statements, industry trends, and broader market dynamics is essential for a well-rounded investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Credit: Source link