In a notable insider transaction, Andrew Rendich, the Chief Supply Chain Officer of Peloton Interactive Inc (NASDAQ:PTON), sold 52,686 shares of the company on November 16, 2023. This sale is part of a series of transactions over the past year, where Rendich has sold a total of 141,712 shares and has not made any purchases. This insider activity raises questions about the executive’s confidence in the company’s future and may signal to investors to reevaluate their positions in Peloton Interactive Inc.Who is Andrew Rendich?Andrew Rendich is a seasoned executive with extensive experience in supply chain management and operations. At Peloton Interactive Inc, Rendich is responsible for overseeing the company’s global supply chain operations, ensuring that the company’s products are delivered efficiently and effectively to customers. His role is critical, especially for a company like Peloton, which relies on a seamless supply chain to meet the high demand for its interactive fitness products.About Peloton Interactive IncPeloton Interactive Inc is a leading interactive fitness platform that revolutionized the fitness industry with its connected, technology-enabled exercise equipment and immersive, on-demand workout experiences. The company’s flagship products include its stationary bikes and treadmills, which are equipped with large touchscreens that stream live and on-demand fitness classes led by professional instructors. Peloton’s business model is based on a combination of equipment sales and a subscription service that provides access to its extensive library of fitness content.Analysis of Insider Buy/Sell and Relationship with Stock PriceThe recent sale by Andrew Rendich is part of a broader pattern of insider selling at Peloton Interactive Inc. Over the past year, there have been 28 insider sells and no insider buys. This trend could be interpreted as a lack of confidence among insiders about the company’s future prospects or simply as part of their personal financial planning strategies.When insiders sell shares, it often leads to speculation about the company’s health and future performance. However, it’s important to note that insiders may sell shares for various reasons that do not necessarily reflect their outlook on the company’s future, such as diversifying their investment portfolio, tax planning, or personal financial needs.

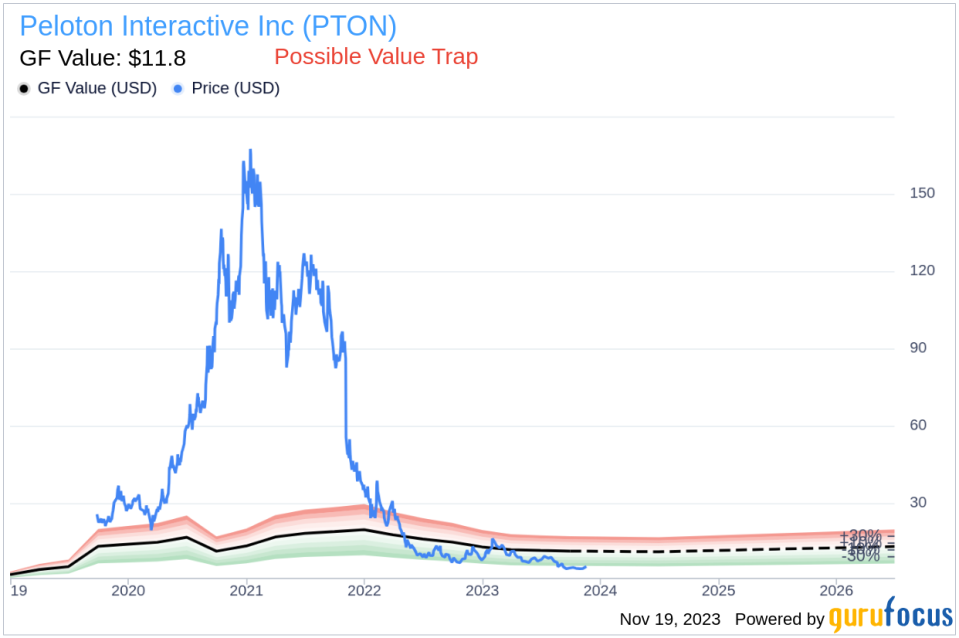

The relationship between insider selling and stock price can be complex. While a pattern of insider selling can sometimes precede a decline in stock price, it is not a definitive indicator. Investors should consider a range of factors, including the company’s financial performance, market conditions, and industry trends, when assessing the impact of insider transactions on stock price.Valuation and Market CapOn the day of Rendich’s recent sale, shares of Peloton Interactive Inc were trading at $5.2, giving the company a market cap of $1.989 billion. This valuation is significantly below the GuruFocus Value (GF Value) of $11.80 per share, suggesting that the stock may be undervalued.

The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on the company’s past performance, and future business performance estimates from analysts. With a price-to-GF-Value ratio of 0.44, Peloton Interactive Inc is currently categorized as a “Possible Value Trap, Think Twice,” indicating that investors should be cautious and conduct thorough due diligence before considering an investment in the stock.ConclusionThe insider selling activity by Andrew Rendich at Peloton Interactive Inc, particularly the recent sale of 52,686 shares, is a significant event that warrants attention from investors. While insider selling does not always predict future stock performance, the consistent pattern of sales and the absence of insider purchases over the past year could be a red flag. Coupled with the stock’s current valuation below its GF Value, investors should carefully evaluate the company’s fundamentals, growth prospects, and market conditions before making any investment decisions. As always, insider transactions are just one piece of the puzzle, and a holistic approach to investment analysis is recommended.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Credit: Source link