In a notable insider transaction, CEO & President Douglas Peterson sold 6,000 shares of S&P Global Inc (NYSE:SPGI) on November 15, 2023. This move has caught the attention of investors and analysts who closely monitor insider activities as an indicator of a company’s financial health and future performance. Understanding the context and implications of such insider transactions is crucial for investors considering a stake in S&P Global Inc.

Who is Douglas Peterson?

Douglas Peterson has been at the helm of S&P Global Inc as the CEO & President, steering the company through various phases of growth and transformation. His leadership has been instrumental in shaping the strategic direction of the company. With a deep understanding of the financial services industry, Peterson’s actions, including his trading activities, are closely watched for insights into the company’s prospects.

About S&P Global Inc

S&P Global Inc is a leading provider of transparent and independent ratings, benchmarks, analytics, and data to the capital and commodity markets worldwide. The company’s divisions include S&P Global Ratings, which provides credit ratings; S&P Global Market Intelligence, which offers high-quality data, research, and analytics; S&P Global Platts, which is known for its energy and commodities information; and S&P Dow Jones Indices, which is a global leader in providing investable and benchmark indices to the financial markets. The company’s commitment to delivering essential intelligence to its clients has solidified its position as a cornerstone in the financial industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions can provide valuable clues about a company’s future. Over the past year, Douglas Peterson has sold a total of 30,657 shares and has not made any purchases. This pattern of selling could suggest that the insider may perceive the stock’s current price as being on the higher side, potentially overvalued, or it could simply be part of a personal financial planning strategy.

When examining the broader insider transaction history for S&P Global Inc, we observe that there have been no insider buys and 26 insider sells over the past year. This trend of insider selling could be interpreted in various ways, but without additional context, it is not necessarily indicative of a lack of confidence in the company’s future prospects.

On the day of Peterson’s recent sale, shares of S&P Global Inc were trading at $405.28, giving the company a substantial market cap of $129.29 billion. The price-earnings ratio stands at 52.80, which is higher than both the industry median of 18.21 and the company’s historical median. This elevated P/E ratio could suggest that the stock is priced optimistically relative to its earnings, which might be a factor in the insider’s decision to sell.

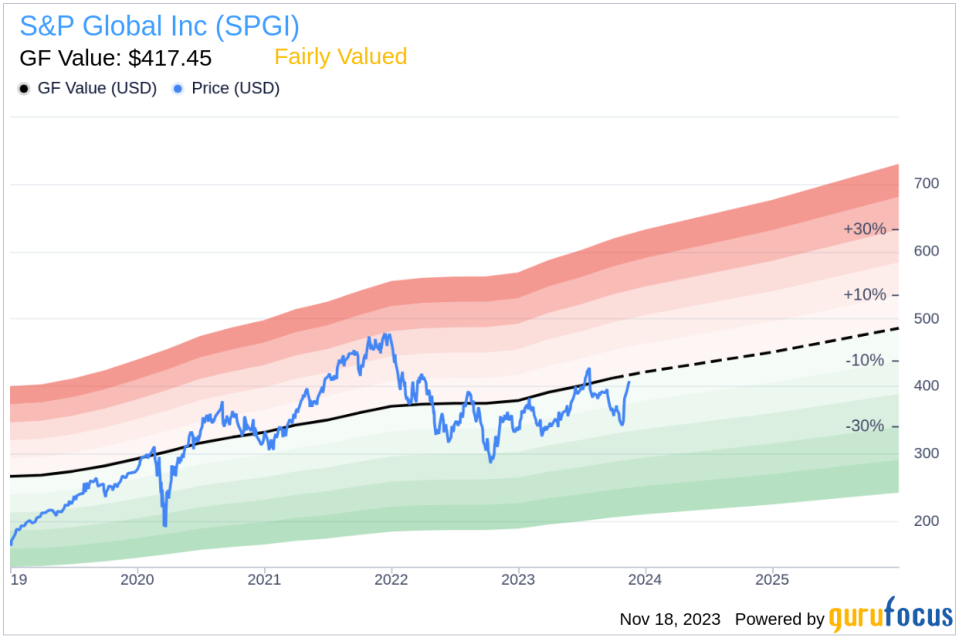

However, it’s important to consider the stock’s valuation in relation to its intrinsic value. With a share price of $405.28 and a GuruFocus Value of $417.45, S&P Global Inc has a price-to-GF-Value ratio of 0.97, indicating that the stock is Fairly Valued based on its GF Value. The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The insider trend image above provides a visual representation of the selling pattern, which could be a signal for investors to consider the timing and rationale behind these transactions.

The GF Value image further illustrates the stock’s current valuation in relation to its intrinsic value, offering investors another perspective to gauge whether the stock is trading at a fair price.

Conclusion

Insider transactions, such as the recent sale by CEO & President Douglas Peterson, are just one piece of the puzzle when it comes to evaluating a company’s stock. While a pattern of insider selling can raise questions, it is essential to consider the broader context, including the company’s valuation, industry position, and future growth prospects. For S&P Global Inc, the stock appears to be fairly valued according to the GF Value, and the company holds a strong position in the financial information services industry. Investors should weigh these factors alongside insider trading patterns to make informed decisions about their investment strategies.

As always, it is recommended that investors conduct their own due diligence and consider multiple data points before making any investment decisions. Insider trading is just one indicator of a company’s health and potential, and it should be analyzed in conjunction with other financial metrics and market trends.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Credit: Source link