Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Berkshire Hathaway’s cash pile surged to a record $157bn in a quarter in which chief executive Warren Buffett continued to sell stakes in publicly traded companies, as the so-called Oracle of Omaha found a dearth of appealing investments.

The company sold more than $5bn worth of US and foreign stocks in the third quarter, according to results released on Saturday. The sales lifted Berkshire’s divestments of listed shares to nearly $40bn over the past year.

Investors must wait a further two weeks before they can see how Buffett adjusted Berkshire’s portfolio. But Saturday’s results filing indicated the company sold more than 12mn Chevron shares before it bought Hess for $53bn in an all-stock deal last month.

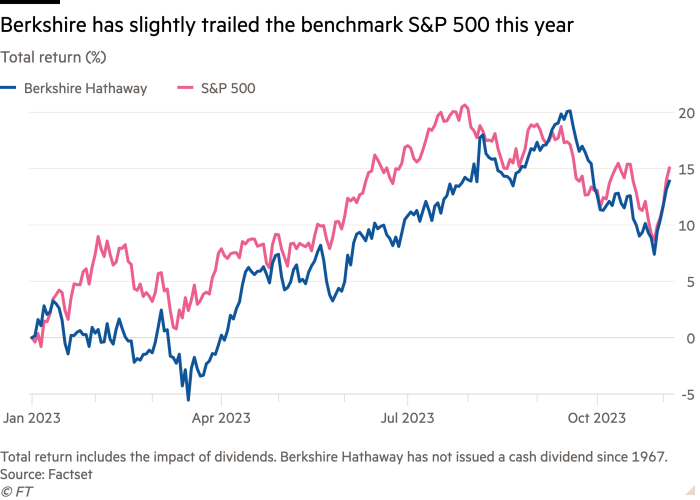

The value of Berkshire’s portfolio of shares shrank to $319bn from $353bn at the end of June, a decline fuelled by the slide in the broader stock market as investors came to believe that the Federal Reserve would keep interest rates higher for longer.

That has weighed on the valuations of publicly traded companies and prompted some portfolio managers to search for better returns in fixed income markets. The value of Berkshire’s stake in Apple alone dropped by more than $20bn, as shares of the iPhone maker fell 12 per cent in the three months to the end of September.

Buffett’s investment shifts are closely scrutinised by fund managers and the wider public alike for clues as to where the 93-year-old investor sees attractive returns.

He directed the proceeds from the stock sales, as well as the cash flows Berkshire’s many businesses generated, into cash and Treasury bills. The company’s cash pile surged during the quarter by nearly $10bn to a record $157.2bn, a sum that gives it formidable firepower for acquisitions.

Berkshire has been one of the big beneficiaries of rising US interest rates, which have climbed above 5 per cent this year. The company disclosed that the interest income it was earning on its insurance investments climbed to $1.7bn in the three-month period, lifting the sum to $5.1bn over the past 12 months. That eclipsed the total interest Berkshire earned on its cash reserves in the preceding three years combined.

“Rates are attractive here and it seems like it creates a hurdle or disincentive to put cash to work if you can earn 4 per-cent risk free,” said Jim Shanahan, an analyst at Edward Jones. “I would suspect that the cash balance probably continues to creep higher from here.”

Buffett disclosed that the company repurchased $1.1bn worth of Berkshire stock in the quarter, down from $1.4bn in the second quarter. However, the filing showed purchases had accelerated in August and again in September, in a sign that the billionaire investor believed shares of the company were undervalued.

The company’s operating businesses, which span the BNSF railroad, Geico insurer and aircraft parts maker Precision Castparts, reported a 41 per cent rise in profits to $10.8bn. The gains were fuelled by its insurance unit, which reported strong underwriting profits of $2.4bn, offsetting weakness at BNSF and reserves for losses tied to wildfire litigation against its utility.

Ajit Jain, a Berkshire vice-chair who oversees its insurance operations, told shareholders at the annual meeting in May that the company had wagered heavily on the Florida insurance market and had written policies in the hurricane-prone state.

It was a risky bet that Jain estimated could cost Berkshire as much as $15bn if the state was hit by powerful storms. But this year, the state experienced a relatively tame season.

Berkshire on Saturday reported that significant catastrophe losses — individual insurance losses that top $150mn — had only reached $590mn in the first nine months of the year. That figure is down from $3.9bn in the same period last year, when Hurricane Ian pummelled Florida.

The company’s Geico auto-insurer, which had struggled to cope with payouts on claims for much of the past two years, showed improvement. The unit has shed more than 2mn policyholders this year and slashed its advertising budget as it focuses on insurance contracts it believes it can profit from.

Outside of insurance, Berkshire’s earnings underscored the uneven economic growth that has confounded economists and much of the investing world. Sales slid at the apparel and shoemakers it owns, which includes Fruit of the Loom, and its real estate-related businesses which continued to struggle with lower demand given high mortgage rates. BNSF also reported lower rail shipment volumes.

However, the company’s fractional private jet ownership business NetJets reported a jump in demand from wealthy clients, and its auto dealerships reported rising sales of new vehicles.

“There is an emerging theme this earnings season that the lower-end consumer is starting to show some cracks, that they may not have much excess liquidity and that they are feeling the pressure from higher costs,” Shanahan added.

Berkshire also detailed the continued fallout from the 2020 and 2022 wildfires that spread through California and Oregon. The company took a $1.4bn charge in the period for payouts its utility will probably have to make to individuals who lost their homes in the blaze, lifting the cumulative charges it has taken for the wildfires to $2.4bn.

Berkshire has warned its ultimate payouts may be far higher; plaintiffs in Oregon alone have sought $8bn in damages.

The decline of the company’s stock portfolio, which is accounted for in Berkshire’s profit statement, dragged down the overall results. The company registered a net loss of $12.8bn, or $8,824 per class A share, compared with a $2.8bn net loss a year before.

Buffett has long characterised the net earnings figures as meaningless, saying the figures can be “extremely misleading to investors who have little or no knowledge of accounting rules”.

Credit: Source link