Crypto markets have given up some ground after rallying sharply to start the week on optimism that a spot Bitcoin ETF could be approved sooner rather than later.

Bitcoin is down 3% in the past 24 hours, while ETH trades 3.5% lower at $1,800. The consolidation comes after Bitcoin hit a 17-month high of $35,900 on Nov. 1, just a day after the world’s most valuable cryptocurrency turned 15.

Meanwhile, the GBTC discount – the difference between the value of a GBTC share and the value of Bitcoin backing it – continues to narrow as investors hope for the conversion of Grayscale’s closed-ended fund into an ETF.

Solana’s SOL is down 9% today but remains up 20% in the past week on positive cues from the ongoing Breakpoint developer conference.

Most of the top 100 digital assets by market capitalization are down over the past day, with the exception of CRO, the token of the Crypto.com exchange; MNT, the network token of an Ethereum Layer 2 backed by ByBit; and Cardano’s ADA token.

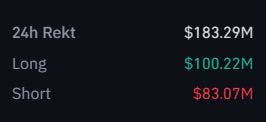

$180M In Liquidations

As of 2pm ET, more than $180M of leveraged positions had been liquidated over the previous 24 hours, with traders on both sides of the market being whipsawed by the volatility.

Prior to the selloff, elevated funding rates on perpetuals exchanges were indicative of retail traders piling on leverage to chase the rally.

Some market participants warned that sentiment was getting ahead of the price action.

Biggest Losers

Crypto casino Rollbit saw its RLB token dive 14% today, the most of any top 100 digital asset. Decentralized graphics solution RNDR and memecoin PEPE dropped 12%.

Prominent projects Aave, Fantom, Lido, Arbitrum, Optimism, Synthetic and Chainlink all shed between 7% and 10%.

Credit: Source link