The FTSE 100 (^FTSE) and European stock markets finished lower on Friday, despite a positive trading session overnight in Asia, after a raft of disappointing earnings numbers from Big Tech companies. US stocks, meanwhile, opened higher as inflation declined.

London’s benchmark index ended 0.8% down after struggling for gains over the past few days, while the CAC (^FCHI) lost 1.2% in Paris.

The Frankfurt DAX (^GDAXI) slipped 0.1% during the session, suffering its 6th successive weekly decline, and falling back to levels last seen in March. The Stoxx 600 (^STOXX) was 0.7% lower.

Across the pond, the S&P 500 (^GSPC) rose 0.2% by the time of the European close, and the tech-heavy Nasdaq (^IXIC) was 1.1% higher as the core personal consumption expenditures (PCE) price index rose by 3.7% in the year to September, down from 3.8% in August.

The Dow Jones (^DJI) was 0.3% down in New York after the bell.

“Core inflation continues to lose speed,” Jeffrey Roach, chief economist for LPL Financial, said. “This report will not likely change the Fed’s view that inflation will slow in the coming months as demand slows.”

Meanwhile, Michael Hewson, of CMC Markets, said: “…Caution over guidance from the likes of Alphabet and Meta Platforms has helped overshadow concerns about an escalation of the conflict in the Middle East between Israel and Hamas,”

The combination of these two factors has also helped to undermine the previously resilient Nasdaq 100, sending it to its lowest levels since May, although it did find support at its 200-day SMA [simple moving average].”

Read more: Trending tickers: Amazon | NatWest | Intel | Alphabet

He added: “With US markets starting to look slightly more vulnerable to a broader correction and an increasingly uncertain geopolitical backdrop there has been little reason for investors to get overly enthusiastic about looking to get back into the market, instead moving into safer haven type plays like gold, the Swiss franc, and US treasuries.”

Blog close and recap

Well that’s all we have time for today. Thanks for following along. Here’s a quick recap of some of the top stories from today…

NatWest plunges on lower guidance and FCA review

Amazon profits triple

Russia hikes interest rates to 15%

US core PCE inflation cools in September

British Airways owner IAG stock falls

Have a good weekend all!

Boris Johnson to become GB News presenter

Boris Johnson is set to become a GB News presenter, programme maker and commentator.

The former prime minister will join the channel next year.

He said on Friday:

I’m going to be giving this remarkable, new TV channel my unvarnished views on everything from Russia, China, the war in Ukraine, how we meet all those challenges, to the huge opportunities that lie ahead for us, why I believe our best days are yet to come.

And why on the whole the people of the world want to see more global Britain, not less.

US consumer confidence falls

US consumer confidence declined this month, as stock markets fell and inflation expectations rose.

The University of Michigan’s Index of Consumer Sentiment dropped to 63.8 this month, down from September’s 67.9, after two months of marginal change.

Joanne Hsu, surveys of consumers director said:

Across all consumers, one-year expected business conditions plunged 16% and expectations over consumers’ own personal finances in the year ahead fell 8%, reflecting ongoing concerns about inflation and, to a lesser degree, uncertainty over the implications of negative news both domestically and abroad.

Amazon set to suffer Black Friday strikes

Amazon is set to face a wave of industrial action on Black Friday next month, one of its busiest days of the year.

Workers at the ecommerce giant will strike in more than 30 countries, including the UK.

Details were finalised at a summit in Manchester on Friday held by campaign group Progressive International.

Spokesman David Adler said Amazon’s financial results showed that the company can afford to pay its workers a decent wage and negotiate with trade unions.

It comes as Amazon’s profit have more than tripled, while quarterly revenues came in at $143bn.

US Core PCE inflation cools in September

The core personal consumption expenditures (PCE) price index rose by 3.7% in the year to September, down from 3.8% in August, new data has shown.

This measure is closely watched by the US Federal Reserve, as it assesses inflationary pressures.

The headline PCE price index was unchanged at 3.4%, on an annual basis.

In September alone, prices rose by 0.4%, including a 0.2% increase in goods, a 0.5% rise in services, a 0.3% increase in food costs and a 1.7% jump in energy.

What’s coming up next week?

We are half way through our Friday so let’s take a quick look at what’s coming up next week…

We have a busy few days in sight with US Fed, BoE and BoJ + US Nonfarm payrolls.

The Fed is expected to leave rates unchanged. Though it left the door open for another hike this year, markets have firmly priced out the chance that this will take place at its Oct 31-Nov 1st meeting. There seems to be a bit of uncertainty around Q4 growth and inflation trends remain encouraging – the Fed has already signalled it’s more about how long it leaves rates this restrictive than worrying too much about another hike.

The Bank of England – having unexpectedly kept rates on hold at the last meeting in a finely balanced decision the Bank of England to all intents and purposes would appear to be done when it comes to further rate hikes. Having hiked 14 times in a row it seems that the bar to further hikes is high indeed and as such we’ve seen a switch in narrative that articulates a policy of higher for longer.

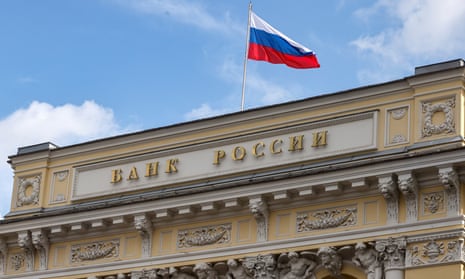

Russia hikes interest rates to 15%

The Russia’s Central Bank headquarter building in Moscow The Bank of Russia has hiked interest rates from 13% to 15% in a bid to combat soaring inflation.

The 200 basis point move was a larger rise than expected as current inflationary pressures have significantly increased to a level above its expectations.

This is the third tightening of monetary policy since the summer. In August, the central bank increased rates from 8.5% to 12% after the rouble weakened through the 100-to-the-dollar mark. It then rose to 13% last month.

The Bank of Russia now expects annual inflation will range from between 7.0 to 7.5% this year, well over its 4% target.

It expects inflation will decline to between 4% and 4.5% next year, “and stay close to 4% further on”.

The rouble surged to a more than six-week high on the back of the news.

Private or agency lettings: Are landlords making the switch?

Almost two thirds (63%) of private landlords are considering switching to a letting agency or property manager, Uswitch has revealed.

No longer dealing with repairs was the leading reason landlords may transfer to a lettings agent.

Almost a third of landlords (27%) said they would switch to a letting agency to avoid scams and fraud.

Uswitch.com buy to let mortgage expert Kellie Steed said:

With both the renters reform bill and higher interest rates on mortgages having a huge knock-on effect on the residential property investment market, some landlords may find the coming months more challenging than usual. While it can feel like selling up is the only option, there are other ways landlords can keep profits afloat during the cost-of-living crisis.

“Switching to a letting management company offers some attractive advantages, and gives landlords the scope to hold onto their investment. Property managers have a strong knowledge of the market’s changing regulations and can also take on much of the responsibility of owning investment property: lettings, repairs, rental disputes and complaints can all be tackled by an agency. Many offer increasingly alluring packages for landlords in return for around 10-20% of profits.

“Remortgaging a property can also save landlords money, as any equity held in the property will give them access to cheaper rates. While a lower interest rate could offer less expensive loan repayments, releasing equity on a property can boost your finances and give you, and your property, more support in the form of a cash sum.”

Amazon profits triple

In this file photo taken on September 20, 2023 an attendee looks on during a media tour of the new Amazon headquarters in Arlington, Virginia. The week so far for Amazon (AMZN) has been one of losses, with its stock cratering on Wednesday as investors were spooked by an apparent slowdown in cloud computing — a key part of its business.

But Friday could see a reversal of its fortunes, as a late earnings report on Thursday revealed its revenues were up 13% on last year, beating analysts estimates. Amazon reported $143.1bn revenue for the quarter ending in September.

Its quarterly profits were $9.9bn, also ahead of estimates, while it touted artificial intelligence (AI) as the future of its business.

Sales for AWS were up 12% on the quarter, to $23.1bn. Its advertising revenue also hit $12.1bn, a 26% increase on last year, when advertisers were still exercising caution in the wake of the pandemic.

As of 10.40am in London, Amazon looked set to open more than 6% higher when markets open later on in the US.

See what other tickers are trending here

ECB survey: inflation back near target by 2025

Eurozone inflation will have almost fallen back to the European Central Bank’s (ECB) 2% target in 2025, according to a new survey.

The ECB’s quarterly Survey of Professional Forecasters showed relatively slow but persistent disinflation over the coming two years.

However, economic growth will remain weak and at below 1% through next year, it said.

The survey sees consumer price growth at 2.7% next year, the same figure predicted three months ago but well below the ECB’s own 3.2% expectation. The 2025 figures was meanwhile lowered to 2.1% from 2.2% and the longer-term forecast, defined as 2028, remained unchanged at 2.1%.

The 2025 GDP growth forecast was cut to 0.9% from 1.1% while 2025 remained unchanged at 1.5%.

Watch: How does inflation affect interest rates?

Download the Yahoo Finance app, available for Apple and Android.

Credit: Source link