While crypto investors remain fixated on the possibility of a spot Bitcoin ETF launching sooner rather than later, the decentralized finance sector has staged a quiet rally, with many tokens outperforming both BTC and ETH.

The market capitalization of DeFi assets is up 15% to $49.4B, a three-month high. Similarly, total value locked (TVL), a measure of the amount of assets deposited in DeFi protocols, has crossed $40B for the first time since August.

In terms of deposits, decentralized exchange Sushi, cross-chain protocol Thorchain, and DAI-focused lender Spark outperformed in October, with TVL up 32%, 25% and 22%, respectively, over the past week alone, according to Defillama.

Bitcoin Hits 17-Month High

It’s been a stellar week for BTC, with the world’s most valuable cryptocurrency up 7% in the last 24 hours and 18% in the past week. The action has been driven by speculation that BlackRock’s spot Bitcoin ETF may be around the corner.

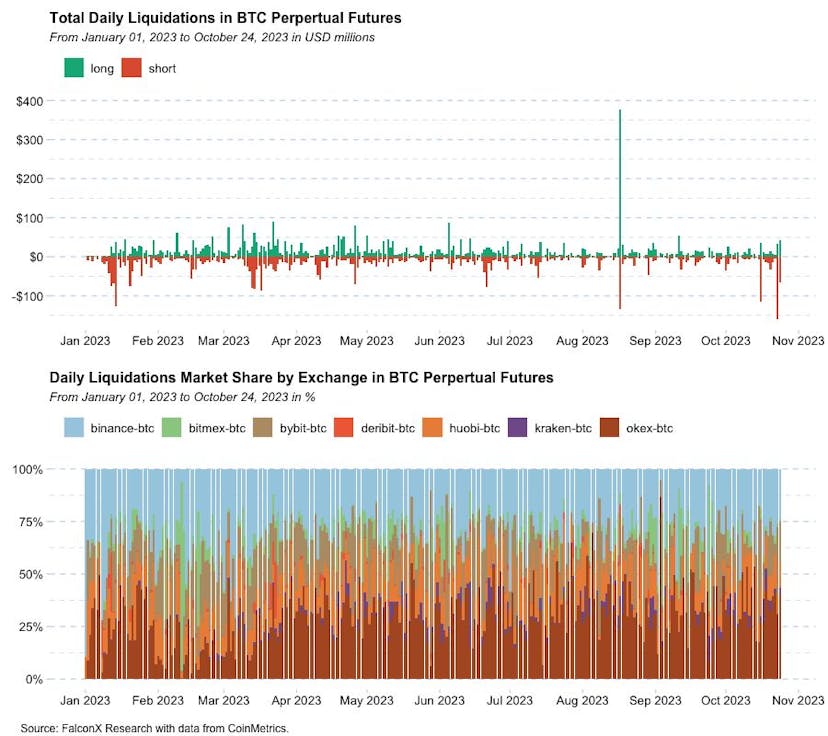

Bitcoin rallied above $35,000 for the first time since May 2022 before paring some gains. According to a chart from David Lawant of FalconX, yesterday’s short liquidations were the biggest in the past year.

Top Gainers

Kwenta, a perpetuals trading protocol operating on Optimism, an Ethereum Layer 2 network, saw its token surge 43% in the past week.

Meanwhile, Thorchain’s RUNE and oracle provider Chainlink’s LINK are up nearly 40%.

DeFi stalwarts AAVE and LIDO have rallied 32% and 22%, respectively, and DYDX is up 29% as the perpetuals exchange gets closer to launching its own Cosmos-based appchain.

Credit: Source link