The uranium market is experiencing its most favorable supply and demand fundamentals in more than a decade, as reflected by the performance of the U3O8 spot price during the third quarter.

After years in the commodities basement, uranium is shaking off the dust and answering the call for carbon-free fuel sources. The market is experiencing a revival in an era that offers a wider array of investment opportunities than the previous bull cycle.

Here the Investing News Network (INN) reviews uranium’s Q3 price action and the factors influencing its performance.

How did uranium prices perform in Q3?

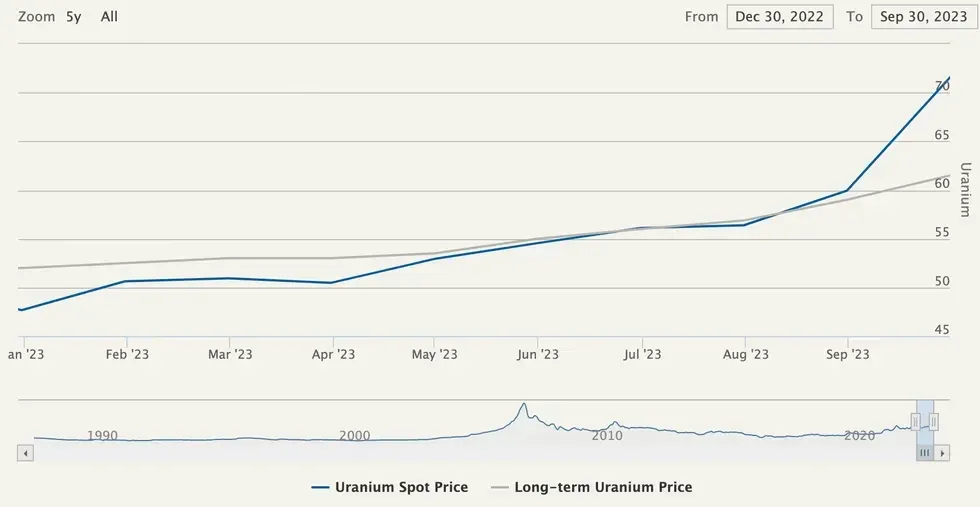

Uranium prices reached levels not seen since before Fukushima, surging past US$70 per pound late in Q3.

Uranium price chart, December 30, 2022, to September 30, 2023.

Chart via Cameco.

The quick rise of more than US$10 has analysts heralding the return of the long-awaited uranium bull.

“The uranium spot price is up fourfold from its bear market bottom, with many individual equities doing even better,” Chris Temple, founder, editor and publisher of the National Investor, told INN via email. “And it’s because uranium’s fundamentals epitomize the dynamic of so many commodities: scarce supply against surging demand.”

Let’s have a closer look at some of the major factors influencing uranium’s price performance in the third quarter.

Nuclear renaissance fueling uranium demand

As the global push toward cleaner energy sources intersects with growing concerns around energy security, governments around the world are investing in nuclear power. The World Nuclear Association (WNA) notes that nuclear power’s promise as a reliable carbon-free source of electricity has allowed it to gain a larger role in the future energy mix.

“The turmoil in energy markets, which had begun even before the current conflict in Ukraine sent fossil fuel prices sky-high, has brought the issue of energy security to the fore, alongside the increasingly urgent requirements for rapid decarbonization to tackle climate change effectively,” said WNA Director General Sama Bilbao y León in July. “An increasing number of governments are recognising the value of nuclear generation to address all of these challenges.”

Japan is finally shaking off the effects of Fukushima by green-lighting restart plans for numerous nuclear facilities, as well as new builds. Meanwhile, China plans to add 32 nuclear reactors to its fleet by 2030. In other regions, including EU countries, the US and Canada, governments are working to extend the life of more than 140 existing nuclear plants. The WNA forecasts that these combined efforts will double annual uranium demand to 130,000 metric tons by 2040.

Utilities purchasing uranium in the spot market

Although growing demand is a key reason why uranium prices are rising, the story is really about supply.

For over a decade, the ultra-low price environment for uranium has led to shuttered production, mothballed expansion plans and little incentive for exploration. Now Russia’s war in Ukraine, political instability in Niger, production cuts by Cameco (TSX:CCO,NYSE:CCJ) and increased speculative buying are exacerbating an already unstable supply chain.

“The supply story is really where I think investors should focus most of their efforts if they’re doing due diligence on the sector,” Justin Huhn, founder and publisher of Uranium Insider, said in a recent interview with INN.

He believes a “supply black hole” is emerging in the medium term.

“The only inventory that exists right now in the world is strategic — this is held by nuclear utilities, and their inventories historically speaking are relatively low, and by nation states,” explained Huhn.

Watch the full interview with Huhn.

All of this has galvanized utilities to secure more of the fuel, which is in turn placing upward pressure on uranium prices.

“The latest spike in the uranium price to the highest level since pre-Fukushima has been a function of converging market forces, some of which had been visible for some time, and others that were less predictable events,” Ben Finegold, who runs uranium research at Ocean Wall, commented to INN via email. “What has been clear for some time is utility uncertainty around future supply as secondary supplies are drawn down and primary supplies tighten; this resulted in increased utility purchasing in the spot market in Q2 and Q3 of this year. The coup in Niger, production cuts from Cameco and increased activity from financial speculators and traders have put further pressure on prices.”

The need for utilities to lock in long-term contracts was on full display at this year’s World Nuclear Symposium, where Mart Wolbert, founder of Contrarian Codex, said he gained insight into what’s on the minds of uranium buyers.

Watch the full interview with Wolbert.

In an interview with INN, Wolbert said it’s apparent that utilities can no longer rely on inventory drawdowns or secondary supply. “The age of inventory overhang is over, and secondary supply is also faltering,” he said. Utilities are now focused more on securing primary uranium supply through contracts, which is a major driver of uranium price discovery.

What’s ahead for uranium prices?

Many of the analysts INN has spoken to in recent weeks believe the uranium sector is in the early innings of a bull market, and investors who have waited through years of low prices and slow movement are here for it.

“When even the high-profile global climate scold Greta Thunberg acknowledges that nuclear power is an important ingredient in reducing carbon emissions, it might pay to take notice! And for many early investors in this sector’s renaissance, it already has,” quipped Temple. “Indeed, of all such stories, I have said for the last couple years and still say that NO commodity has a better supply/demand setup than uranium, nor is any as insulated from a global economic downturn.”

In June, Temple said the market could see US$100 uranium inside of two years. The widely held belief is that robust demand will inevitably overtake an ever-weakening supply side that has little chance of catching up in the short to medium term.

“While US$70 uranium provides an incentive to bring online some idled capacity, the reality is prices will need to move much higher in the next couple of years as the supply deficit widens and demand for uranium increases. Our belief is the supply/demand models of today significantly underestimate Chinese consumption, (small modular reactor) growth and scarcity of inventories,” noted Finegold. “Particularly noteworthy is Kazatomprom (LSE:59OT,OTC Pink:NATKY), who after various management changes have failed to provide clarity in their mega deal with the Chinese. This has the potential to put over 40 percent of global supply in the balance and is a story we believe the market continues to underestimate.”

For his part, Wolbert said uranium prices need to reach and sustain above the US$85 to US$90 level to really incentivize new production. However, higher prices will not necessarily translate to new supply coming to the market right away given entrenched workforce, materials transportation and intellectual capital challenges. “I believe a supply response, even at much higher prices, will take time to come online, which means that prices likely will go much higher for much longer,” he said.

Goehring & Rozencwajg Managing Partner Adam Rozencwajg told INN he thinks it’s entirely plausible that uranium could spike to US$300. The market couldn’t sustain that level for long, but it’s not entirely out of the realm of possibility with more investment vehicles like the Sprott Physical Uranium Trust (TSX:U.U) launching and snapping up mobile uranium inventory.

Watch the full interview with Rozencwajg.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

From Your Site Articles

Related Articles Around the Web

Credit: Source link