What should we make of today’s market conditions? Investors are digesting how the Federal Reserve’s ‘higher for longer’ interest rate policy will impact the economy, and they’re not pleased with the prospect. Other challenges on the horizon include the ongoing Congressional budget battles, lingering inflation, the evaporation of consumer savings and purchasing power, and concerns over China’s incendiary combination of slowing growth, geopolitical ambition, and approaching demographic collapse.

That’s a lot to digest, but covering the situation from banking giant J.P. Morgan, global investment strategist Madison Faller believes there is some reason for optimism through the autumn.

“When it comes to stocks, the recent selloff means valuations are more reasonable today than they were before… Focusing on valuations alone also ignores the actual experience of companies. The S&P 500 has already suffered through three quarters of earnings declines, and expectations for future earnings have been rising steadily over the last six months. Despite all the worry, that backdrop could spur stocks to new highs over the next year… Staying invested through the uncertainty has typically served investors best,” Faller opined.

So, given this optimistic perspective, the question is, which equities should investors consider adding to their portfolios? J.P. Morgan analysts have pinpointed two names they believe would be valuable additions.

And they are not alone; according to TipRanks’ database, both stocks are also rated as ‘Strong Buys’ by the analyst consensus. Let’s see why they are drawing plaudits across the board.

Amicus Therapeutics (FOLD)

We’ll start in the biotech sector, where Amicus is a biopharmaceutical company with a focus on the treatment of rare diseases. These are typically disease conditions with small patient bases and devastating effects. Amicus is working on new therapeutic agents with novel actions to deliver advanced treatments with a patient-centered focus.

This company has achieved its goal and reached the brass ring – it now has two approved drugs on the market. The first of these, Galafold, is a treatment for adults suffering from Fabry disease; the second is a combination therapy, Pombiliti and Opfolda, used in the treatment of late-onset Pompe disease.

These approved drugs have given Amicus a steady revenue stream. The company reported $94.5 million in global revenue for 2Q23, the last quarter reported, beating the forecast by ~$4.6 million. The revenue was also up 17% year-over-year.

Looking ahead, Amicus is predicting that sales of Galafold will show revenue growth in the 14% to 18% range for the full year 2023. The company credits this outlook to high demand and commercial expansion in the US, UK, EU, and Japanese markets. Also of note, Amicus has received regulatory approval from the EU in Q2 for the commercial launch of the Pombility+Opfolda combination therapy.

JPMorgan analyst Anupam Rama is impressed by the full commercialization potential of Amicus, writing of the company, “With peak sales of ~$600M+ for Galafold and ~$750M+ for Pombiliti + Opfolda, we believe that FOLD shares are undervalued. As Pombiliti + Opfolda was approved in Pompe disease in 3Q23, we believe that the therapy shows best-in-class potential and it has been noted that the therapy is preferred by KOLs we have spoken with…”

“Net-net, at current valuation levels, we continue to think that solid execution on the Galafold and Pombiliti + Opfolda should drive value into the mid- to high-teens / share level,” Rama summed up.

Looking ahead, Rama rates FOLD an Overweight (i.e. Buy), and sees it hitting a share price of $19 for ~71% one-year upside potential. (To watch Rama’s track record, click here)

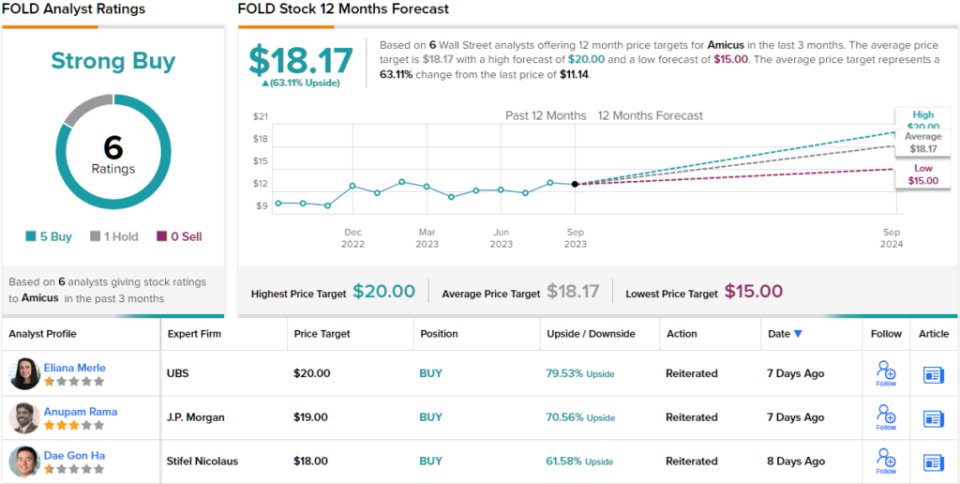

Overall, the Strong Buy consensus rating on this stock is supported by 6 recent analyst reviews, including 5 Buys and 1 Hold. The shares are priced at $11.14 and their $18.17 average price target implies a 12-month gain of 63%. (See FOLD stock forecast)

DigitalBridge Group (DBRG)

Next up is DigitalBridge, a digital investing firm with a global footprint. The company has 25 years’ experience working with businesses across the digital ecosystem, and has a network of investments in cell towers, small cells, data centers, fiber networks, and edge infrastructure. DigitalBridge buys, builds, owns, and operates these assets; it forms a vital link connecting digital providers with customers.

As of the end of 2Q23, the last reported, DigitalBridge had invested some $4 billion in portfolio growth this year. The greatest expansion took place in the data center and tower segments of the portfolio, which each grew in Q2 by more than 21% year-over-year; the company’s fiber portfolio was up more than 15%.

In global revenues, the second quarter was a good one for DigitalBridge. The company’s $425 million top line was up a modest 2% y/y, but it beat the forecast by more than $125 million. The company also reported $0.06 per share in distributable earnings, a result that easily covers the 1-cent dividend paid out to common shareholders.

Among the bulls is JPMorgan analyst Richard Choe who sees DigitalBridge in a sound position to continue growing. The company is directly involved in the expanding digital industry, and offers investors an indirect route of exposure to networking tech, according to Choe.

“The transformed DigitalBridge is a direct way for investors to benefit from digital infrastructure investment management on a global basis without being fully invested to one vertical and region. Investors are looking for focused alternative asset managers and digital infrastructure is highly attractive given long-term growth prospects, scale and return potential. We believe DBRG will be able to raise capital in a more stable financial environment as rates level off and digital infrastructure gains broader appeal to pension, sovereign wealth and other infrastructure funds,” Choe opined.

Taking this view forward, Choe rates DBRG shares an Overweight (i.e. Buy), with a $25 price target to imply a solid 57% upside potential on the one-year horizon. (To watch Choe’s track record, click here)

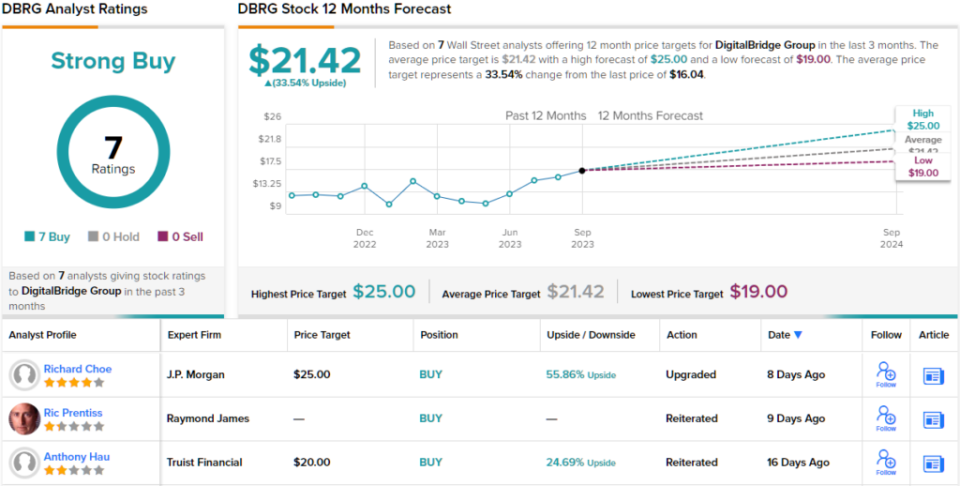

All in all, DigitalBridge gets a unanimous Strong Buy consensus rating, based on 7 positive analyst reviews. The shares are currently trading for $16.04, and their $21.42 average price target indicates room for a one-year gain of 33.5%. (See DBRG stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Credit: Source link