It’s a new year, the best time yet to start investing. After all, compounding does its best work late. The sooner you start, the more wealth you’ll build over time.

One of my favorite aspects of investing is that the stock market doesn’t discriminate. You can prosper whether you’re already well-off or starting with just $500. Everyone can benefit from owning stocks.

Putting pen to paper — deciding which stocks to own (with thousands to choose from) can be the hardest part of the process. This list is a great reference for those looking for a starting point. Here are five great stocks you can confidently buy for the long term…and $500 will get you at least one share of every stock.

1. Palantir Technologies

Software company Palantir Technologies (NYSE: PLTR) hasn’t been around long, but it’s already made a name on Wall Street. The company builds specialized software for government and enterprise customers on its proprietary platforms. This software helps analyze data and aid in real-time decision-making. Palantir’s technology is helping optimize supply chains, detect financial fraud, run military operations, and more.

The company launched its Artificial Intelligence Platform (AIP) in 2023, a platform for launching artificial intelligence (AI) models. There’s already been tremendous demand, which should bode well for Palantir’s long-term growth prospects. The stock has outperformed the market since going public, and that could continue if AI is the investing opportunity it appears to be.

2. Advanced Micro Devices

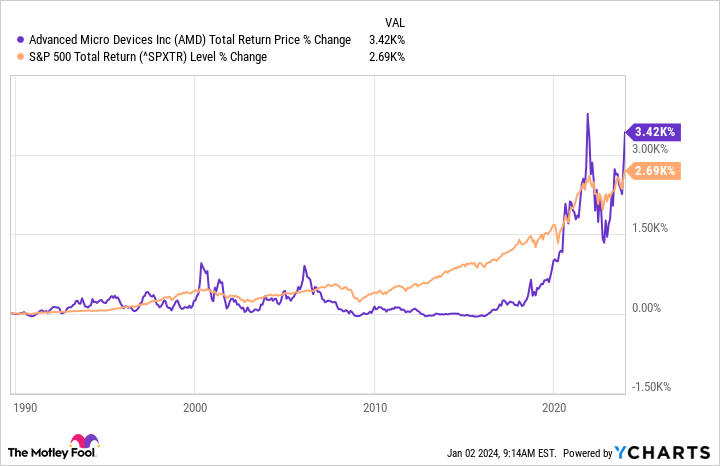

AI requires tremendous computing power, which boils down to the chips that power the computers. Advanced Micro Devices (NASDAQ: AMD) has an enormous growth opportunity ahead, even if rival Nvidia has gotten most of the hype. AMD recently announced a new generation of AI chips it claims can outperform Nvidia’s core data center product, its H100 series.

AMD’s CEO, Lisa Su, believes the AI chip market could hit $400 billion by 2027, setting the company up for solid growth if it can capture a slice of that opportunity. AMD has historically outperformed the broader market as technology advances demand more (and increasingly advanced) chips. Don’t overlook AMD as a long-term AI stock.

3. Nike

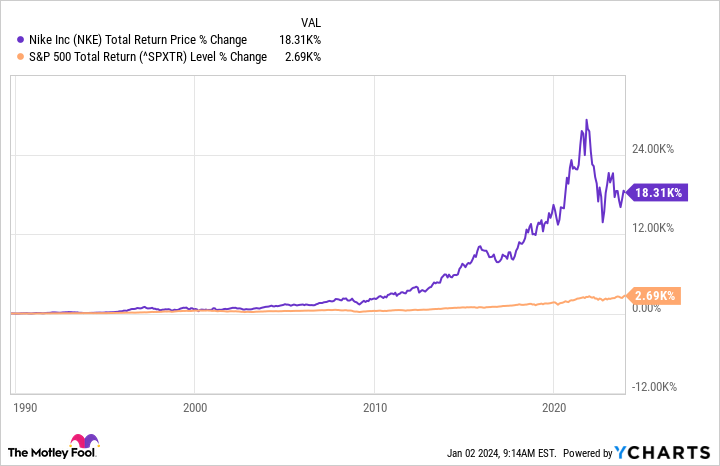

A common investing tip is to buy what you know. Sports apparel giant Nike (NYSE: NKE) is one of the world’s most recognizable brands. Sports are a part of global culture, and the company’s success in tying its brand to the sporting world’s biggest names has fostered years of market-beating growth. Today, Nike has a $165 billion market cap, so blistering returns may be harder to come by simply because of how big the company is.

But don’t count the Swoosh out. Nike has evolved, building a blossoming direct-to-consumer business that helps it engage directly with customers and cut out some of the cost of selling through wholesalers. The company’s global recognition should help to keep pushing the ball forward in emerging markets like India and China, where consumer spending still has room to grow.

4. Shopify

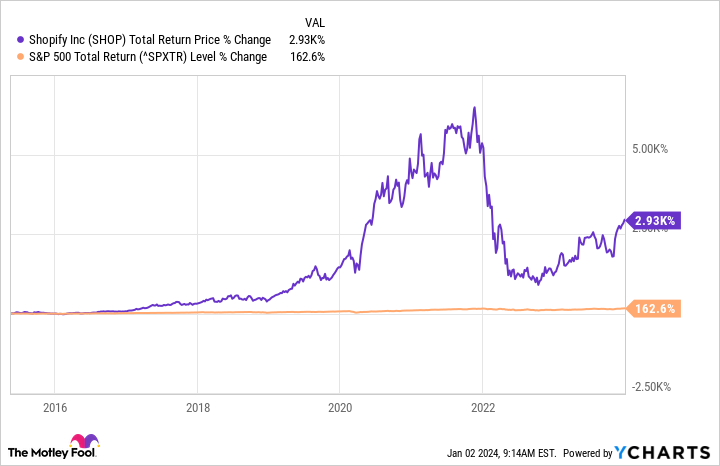

Most people know that Amazon dominates online shopping in the United States. Shopify (NYSE: SHOP) is helping companies worldwide compete with Amazon. The company’s software platform makes it simple for merchants to set up and run an online store. Shopify’s users range from single entrepreneurs to corporations. Collectively, $56 billion in transactions flowed through Shopify in Q3, so all those shops add up to big business.

Consumer spending is crucial to the North American economy. In the United States, just 15% of retail is online after decades of growth. In other words, the growth story of e-commerce is nowhere near over. Shopify should continue riding this trend for years, helping millions of businesses compete with the industry’s biggest players worldwide.

5. Walt Disney

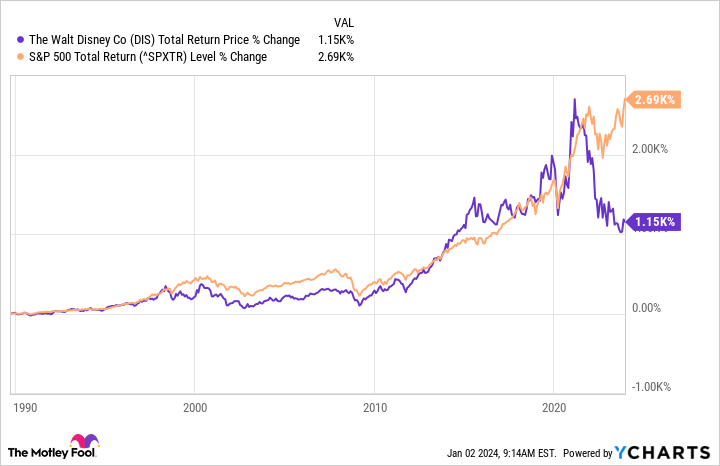

This stock needs little introduction. The Walt Disney Company (NYSE: DIS) is a media behemoth, home to Disney’s collection of intellectual property, including Pixar, Star Wars, Marvel, Disney, ESPN, and more. It’s leaned on its media to create theme parks, cruise lines, and merchandise found worldwide. Ironically, despite its fame, it’s the only stock on this list that hasn’t beaten the broader market over its lifetime.

The company began pivoting to streaming, launching Disney+ in 2019. It’s been a few challenging years as Disney sought to grow its streaming memberships over making money. With over 100 million households using Disney+, that could begin to change. It’s hard not to see Disney’s powerful cache of media not creating value for shareholders over the long run.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of December 18, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Nike, Nvidia, Palantir Technologies, Shopify, and Walt Disney. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

5 Stocks You Can Confidently Invest $500 in Right Now was originally published by The Motley Fool

Credit: Source link