Since going public at $40 per share in September 2021, Toast‘s (NYSE: TOST) stock price has significantly underperformed the market. It has declined over 50% from its IPO valuation, while the S&P 500 (SNPINDEX: ^GSPC) index gained 6% in the same span. In its first year as a public company, Toast’s share price fell as much as 70% in 2022 amid a volatile market environment — especially for high-growth stocks with minimal profits — and stayed down while many other beaten-down stocks soared.

But one shareholder’s nervous sale can be another investor’s buying opportunity. In this case, the provider of cloud-based business tools for every type of restaurant is poised to perform from this bargain-bin starting point.

Let me show you the three best reasons to consider adding some Toast stock to your portfolio today.

Toast is growing where it matters

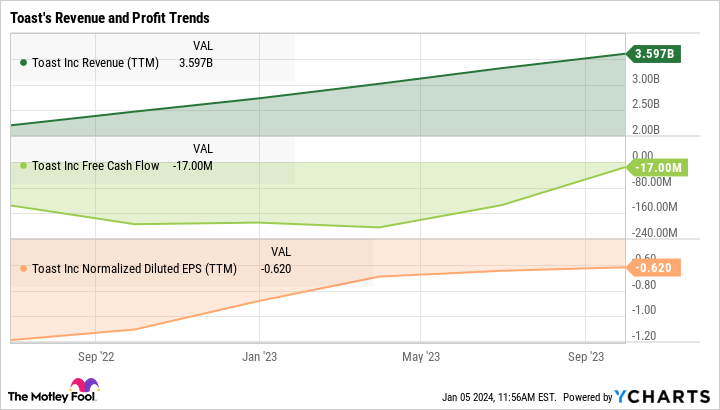

Bearish investors take one look at Toast’s negative earnings and free cash flows across the trailing 12 months before moving on to the next idea. That’s a deal-breaker for many value-oriented stock buyers. I certainly don’t expect classical value wizard Warren Buffett to invest in Toast anytime soon, for example.

However, the business is moving in the right direction.

Revenue rose by 37% year-over-year in the recently reported third quarter of 2023. Quarterly sales passed $1 billion for the first time.

Toast’s net loss stopped at $31 million in the same quarter — less than one-third of the $98 million loss seen in the year-ago period.

Free cash flow swung from an outflow of $80 to a $37 million inflow.

And these bullish trends should continue for the foreseeable future. For example, management boosted their full-year guidance on adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) from roughly $25 million to approximately $43 million.

So Toast may not be classically profitable quite yet, at least not on a sustained basis, but the top line is soaring, and the profit margin is headed into positive territory. That’s unmistakable good news.

The company solves pain points in a complex industry

Toast’s restaurant management system was designed to streamline and enhance the operational efficiency of restaurants. And the whole business starts with Toast’s powerful cloud-based software. In 2021, co-founder and president Steve Fredette said that Toast focused on substance over hype, unlike many lesser tech upstarts seeking quick payoffs for flimsy business plans.

Integrating point-of-sale (POS) services, digital ordering, and customer relationship management into a single platform aims to simplify restaurant management’s complexities. This system helps manage day-to-day operations and provides valuable insights through data analytics, enabling restaurant owners to make informed decisions about their business. Actual sales trends feed directly into the next marketing campaign, for instance.

Most restaurants manage these functions with tools from various vendors (or basic spreadsheets, in some cases), and making them work together is a challenge. Toast makes it easier to run your restaurant business from a single, cloud-based platform.

Furthermore, Toast’s adaptability allows it to cater to a wide range of restaurant types, from small cafes to large, multi-location establishments. Most clients have been smaller, local restaurants so far, but Toast is also landing larger clients over time.

The company cracks many tough nuts in a massive industry. The global foodservice market accounted for sales of $2.3 trillion in 2022 and should grow to $5.4 billion by 2030, according to a recent analysis by Fortune Business Insights.

Just a small slice of that gigantic opportunity could turn Toast into a global giant in a hurry.

The stock is found in Wall Street’s bargain bin

Despite its promising financial trends and equally inspiring market position, investors have not yet embraced Toast’s long-term growth story. You saw the bearish price trend earlier, and the stock has fallen another 7% in the last 52 weeks. It trades at a modest 2.7 times trailing sales, which is a bargain when you consider the rapid revenue growth and improving profit margins.

Making money in the stock market often involves finding tomorrow’s business giants before the average investor does. Toast isn’t perfect yet, but sales are soaring and the profit metrics should follow as the company unlocks significant economies of scale.

A low price isn’t a strong “buy” signal on its own. Toast pairs its modest stock price with bullish business trends and a top-notch business plan., though. Long story short, the buying window for Toast stock is wide open right now.

Should you invest $1,000 in Toast right now?

Before you buy stock in Toast, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Toast wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of December 18, 2023

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Toast. The Motley Fool has a disclosure policy.

3 Reasons to Buy Toast Stock Like There’s No Tomorrow was originally published by The Motley Fool

Credit: Source link