The stock market roared back last year with the help of cooling inflation, a resilient U.S. economy, and a healthy jobs market. The best part is that some noted Wall Street analysts think the rally will continue in 2024.

Tom Lee of investment research firm Fundstrat said he expects the S&P 500 (SNPINDEX: ^GSPC) index to rise an added 9% in 2024 to 5,200. Lee also said there is a better-than-50% change that the index will jump by double-digit percentages this year. There’s also a scenario, he noted, wherein the index could jump 30%.

Lee says that if corporate earnings grow by 10% and the S&P 500 index maintains a price-to-earnings ratio of 20 — which has been the case more than 50% of the time when the 10-year Treasury yield ranges between 3% and 4% — stocks could clock much stronger gains. With the 10-year Treasury yield hovering just around 4% now and inflation expected to drop to 2% this year, it won’t be surprising to see Lee’s bullish forecast turning into reality.

After all, Lee predicted a 20% jump in the S&P 500 last year, and his forecast turned out to be true as the index gained 24.2% in 2023. As such, investors would do well to buy the following two names hand over fist before the market goes on a bull run once again in 2024.

1. Intel

Intel (NASDAQ: INTC) stock’s 90% jump in 2023 surprised investors and market watchers alike as the chip giant has been a perennial underperformer. Shares of Intel were relatively flat over the past five years, underperforming the S&P 500’s gains of 85% over the same period.

Intel stock got a big boost in 2023 thanks to the broader rally in semiconductor stocks. The PHLX Semiconductor Sector index gained 67% last year, thanks to catalysts such as artificial intelligence (AI). The good news is that semiconductor stocks could have another stellar year.

IDC expects semiconductor revenue to increase at least 20% in 2024, compared to a 12% decline last year. That could lead to even more upside in shares of Intel in 2024, as the company is on track to benefit from some hot growth trends within the semiconductor industry.

For instance, an 8% jump in sales of personal computers (PCs) in 2024 following a 12.4% decline last year is going to lift Intel’s largest business segment — the client computing group — which relies on sales of laptops and desktop computers. This business accounts for 55% of Intel’s top line. It’s also worth noting that Intel controls 80% of the market for laptop and notebook CPUs (central processing units), according to Mercury Research, which puts it in a nice position to capitalize on the market’s recovery.

Meanwhile, Intel’s AI chip pipeline is also growing at a nice pace. The chip giant was sitting on a $1 billion AI revenue pipeline in the second quarter of 2023, a number that reached almost $2 billion in the following quarter. There’s a good chance that Intel’s AI chip pipeline will continue expanding on the back of the growing need for AI inferencing, the adoption of small- to mid-sized large language models (LLMs), and the need for general computing chips within AI servers in the long run.

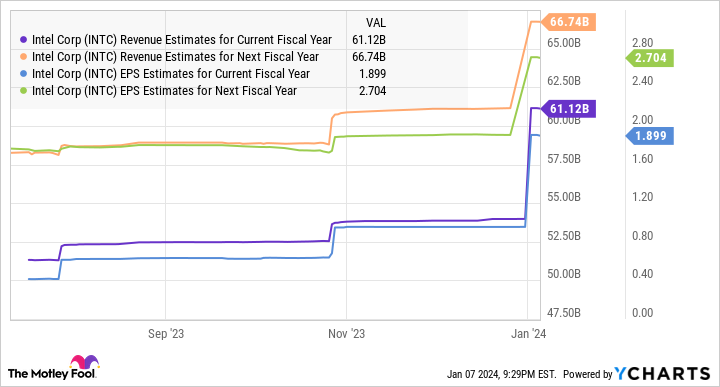

All this explains why Intel’s revenue and earnings could grow nicely in 2024 following steep declines in 2023. The company’s full-year 2023 revenue is expected to drop 14% to $54 billion, while earnings are projected to decline 48% to $0.95 per share.

Investors should consider buying this semiconductor stock right now given that it’s trading at just 26 times forward earnings, a nice discount to the tech-laden Nasdaq-100 index’s forward multiple of 29.

2. CrowdStrike

CrowdStrike (NASDAQ: CRWD) stock shot up 161% in the past year, and the company could sustain its impressive run in 2024 thanks to improving conditions in the cybersecurity market. Market research firm Gartner estimates that the overall cybersecurity market could grow 14% this year to $215 billion, which would be slightly higher than the pace at which this space grew in 2023.

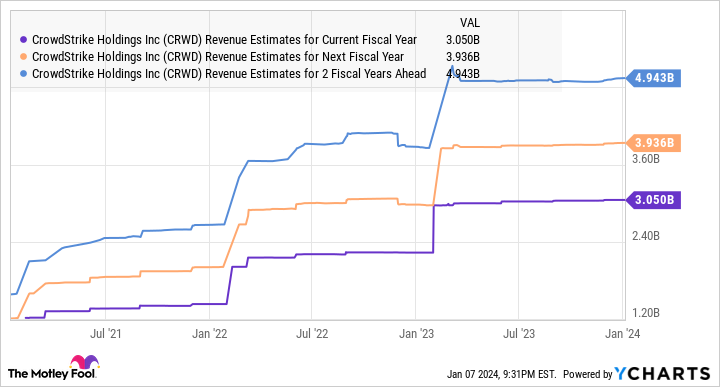

The cloud security market, which CrowdStrike serves, is anticipated to jump 25% to almost $7 billion this year, up from $5.6 billion last year. CrowdStrike is known for providing a cloud-native cybersecurity platform that allows its customers to secure identity, data, endpoints, and workloads in the cloud. The company’s fiscal 2024 revenue (which will end this month) is expected to land at $3.05 billion, an increase of 35% over the previous year.

According to Gartner’s estimate that the cloud security market generated $5.6 billion in revenue last year, CrowdStrike’s share of this space should stand at a whopping 54% based on the company’s fiscal 2024 revenue guidance. This solid share of the fast-growing cloud security market explains why CrowdStrike is expected to keep growing at a nice pace going forward.

More importantly, CrowdStrike can sustain its healthy levels of growth for a longer period. That’s because the global cloud security market is expected to clock a compound annual growth rate of 35% through 2032 and generate a whopping $148 billion in annual revenue. This explains why analysts are predicting CrowdStrike’s earnings to increase at an annual pace of almost 42% for the next five years.

It’s also worth noting that the company is taking steps to capitalize on new trends within the cybersecurity market, such as the growing adoption of generative AI. The company released a generative AI-powered cybersecurity analyst known as Charlotte AI last year, pointing out that it “can turn hours of work into minutes while democratizing cybersecurity, unlocking value and adoption…”

Bloomberg Intelligence estimates that generative AI-focused cybersecurity spending could jump from just $9 million in 2022 to $3.1 billion in 2027. This figure is anticipated to jump to almost $14 billion in 2032. CrowdStrike, therefore, is doing the right thing by moving into this market while it is still in its infancy, as such a move could unlock a new growth opportunity for the cybersecurity specialist.

Investors, however, may be wondering if they should buy CrowdStrike following its tremendous run in the past year. After all, the stock trades at 21 times sales right now. However, a forward price-to-sales ratio of 15 points toward the healthy growth that CrowdStrike is anticipated to deliver. Moreover, its forward earnings multiple of 60 is lower than the average five-year forward price-to-earnings ratio of 388.

We saw earlier that CrowdStrike’s earnings could increase at an annual rate of 42% over the next five years. Using its fiscal 2024 earnings guidance of $2.95 per share as the base, CrowdStrike’s bottom line could jump to $17 per share after five years. Multiplying that with the Nasdaq-100 index’s forward earnings multiple of 29 (using the index as a proxy for tech stocks) points toward a stock price of $493, which is nearly double the current levels.

Investors looking for a growth stock that could keep rising in 2024 and beyond can consider buying CrowdStrike stock before it moves higher and doubles in the long run.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of the S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of December 18, 2023

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike. The Motley Fool recommends Gartner and Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

The Stock Market Could Soar 30% in 2024: 2 Magnificent Growth Stocks to Buy Hand Over Fist Before That Happens was originally published by The Motley Fool

Credit: Source link