There are many reasons to invest in excellent dividend stocks. Such investments are often worth the trouble regardless of whether you’re investing for the dividend, or for making capital gains from the robust business (always a laudable goal). But here’s the common thread that runs through outstanding dividend stocks: Companies that grow their dividend payouts over extended periods time all have solid fundamentals.

The obvious corollary is, not every dividend payer on the market is worth investing in. But let’s consider two that are: Novartis (NYSE: NVS) and Visa (NYSE: V).

1. Novartis

What makes a drugmaker like Novartis a great dividend stock is its portfolio of lifesaving medicines that physicians will continue prescribing regardless of economic conditions. That translates into steady revenue and profits, irrespective of economic expansions and recessions, for the pharmaceutical giant. Moreover, the need for innovative therapies isn’t going to subside anytime soon. In fact, it will only increase over the long run as the world’s population ages.

Novartis is a highly innovative company that has shown the ability to launch new drugs that benefit from patent protection for up to 20 years in the United States, an important competitive advantage. However, one of Novartis’ most important products, psoriasis treatment Cosentyx, will run out of patent protection by 2026. Last year, Cosentyx generated nearly $5 billion in sales, a 5% year-over-year increase.

Fortunately, Novartis should be able to handle this patent cliff. Its biggest growth driver, heart failure medicine Entresto, is still going strong, generating a revenue of $6 billion in 2023, 30% higher than in 2022. Further, newer approvals like Fabhalta should help smooth out Cosentyx’s declining sales, once that starts happening. Fabhalta earned regulatory approval in December as a treatment for a rare blood disorder called paroxysmal nocturnal hemoglobinuria, with some analysts predicting peak sales of as much as $3.6 billion.

Based on its past record, Novartis should continue to make clinical and regulatory progress. That’s why the drugmaker has sustained its strong dividend program for so long. Novartis has increased its payout for 27 consecutive years, an impressive track record. The dividend yields 3.9% with a reasonable cash payout ratio just under 51%. Novartis’ dividend looks secure for the long haul.

2. Visa

Visa has a fantastic business model. The company’s payment network facilitates credit card transactions and charges a fee for every one of them. However, Visa is insulated from credit risk since it does not issue credit cards itself. It merely serves as an intermediary between issuing banks and businesses trying to collect payments from consumers. There are several other aspects of Visa’s business worth mentioning.

Consider the company’s network effect: the more consumers join its ecosystem (by having Visa-branded credit cards), the more attractive it becomes to businesses. That’s why Visa is one of the two undisputed leaders in its industry. It is difficult to find companies that don’t accept Visa as a form of payment. In most developed countries, that would amount to turning down millions of potential customers.

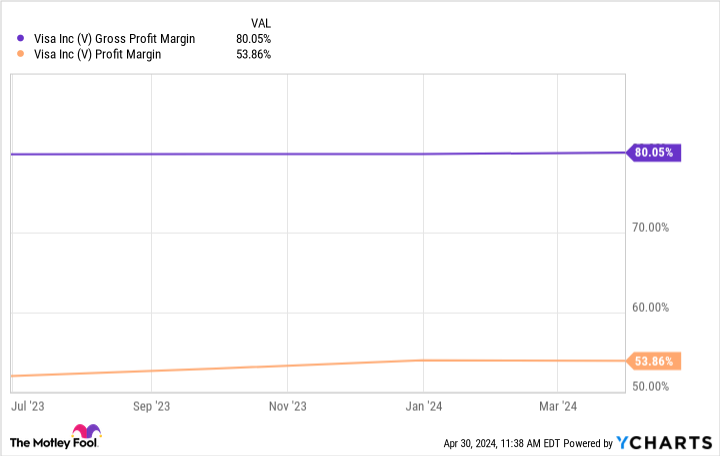

The company’s reach and position are so entrenched that it is difficult to see the company being knocked off its pedestal anytime soon. Furthermore, Visa benefits from high margins because it already has a well-established payment network, and additional transactions do not increase the costs of producing its main service. That translates into strong operating and net profits.

Visa will thrive so long as the number of transactions conducted under its banner increases. And on that front, things are looking good. The company is still looking to phase out cash and check transactions, which, despite appearances, are still widespread. Visa is far from having peaked. That is unlikely to happen in the next decade. Visa’s dividend growth has been impressive over the past 10 years, increasing by 420%.

Its dividend yield of 0.77% and cash payout ratio of 20% indicate that, if anything, the company has the means to raise its dividend substantially without being at risk of running out of cash. That’s why investors can safely hold this dividend stock for the next 10 years.

Should you invest $1,000 in Novartis Ag right now?

Before you buy stock in Novartis Ag, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Novartis Ag wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of April 30, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Visa. The Motley Fool has a disclosure policy.

2 Magnificent Dividend Stocks to Hold for the Next Decade was originally published by The Motley Fool

Credit: Source link