In a week marked by cybersecurity breaches, Ripple’s co-founder’s XRP wallet fell victim to a sophisticated hack. Over 200 million XRP tokens were illicitly extracted and dispersed across various exchanges within a narrow timeframe.

This incident, brought to light by cybersecurity analyst ZachXBT, led to increased selling of XRP tokens, underscoring the persistent vulnerabilities within the crypto market.

100 Million XRP Sold Last Week

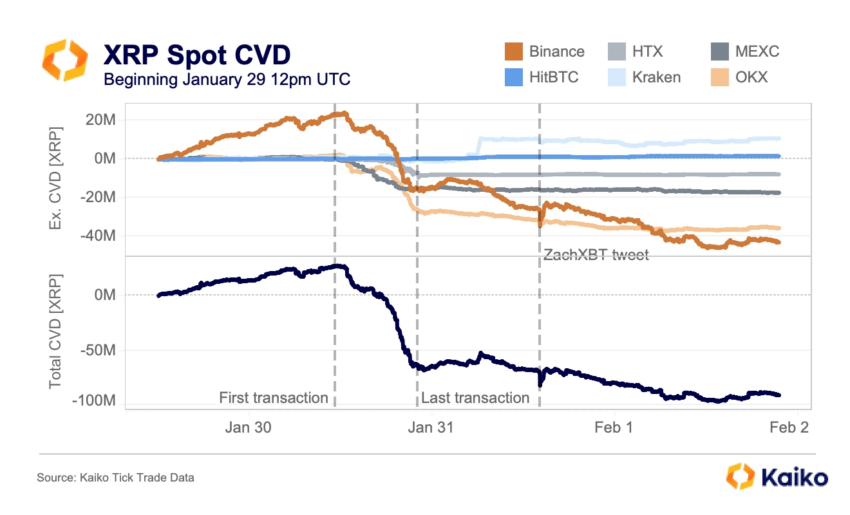

Blockchain analytics firm Kaiko provided insight into the aftermath of the recent security breach. The firm’s analysis revealed a Cumulative Volume Delta (CVD) indicating a net sell-off of nearly 100 million XRP, predominantly on leading exchanges Binance and OKX.

Despite the hacker’s intent to liquidate a vast amount of stolen XRP tokens, swift action from the exchanges led to freezing the assailant’s accounts, preventing a total sell-off.

“Ripple’s XRP Cumulative Volume Delta (CVD) – a measure of net buying and selling – showed a net sell-off of nearly 100mn XRP, primarily on Binance and OKX after last week’s hack of Ripple’s co-founder,” analysts at Kaiko said.

However, the damage was already done. This mass liquidation exerted unprecedented selling pressure on XRP, prompting a notable dip in its market valuation. Therefore, XRP struggled to maintain its position, especially against a backdrop of regulatory scrutiny.

The cryptocurrency’s inability to hold above the critical support level of $0.55 signaled a bearish turn. Indeed, this could precipitate a potential downward trajectory toward $0.37. This movement reflects the immediate impact of the hack and aligns with broader market trends and regulatory challenges facing Ripple.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

Adding to Ripple’s woes, the SEC’s recent legal victory compelling the company to disclose financial statements and details regarding institutional sales of XRP casts a long shadow. This development is pivotal, as it could further influence XRP’s market position and investor sentiment.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Credit: Source link