Warren Buffett, the CEO of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), has long been revered as one of the greatest investors of all time. His ability to consistently beat the market over decades stems from a fundamental principle: investing in high-quality businesses with durable competitive advantages that generate consistent returns over the long term.

One stock that exemplifies Buffett’s investment philosophy is American Express (NYSE: AXP), a company that has been a cornerstone of Berkshire Hathaway’s portfolio for decades. American Express first appeared in Buffett’s portfolio in 1964, when he seized an opportunity created by the infamous “salad oil scandal” that had shaken the company’s share price.

Although Buffett didn’t retain his original shares, he later made American Express a significant holding for Berkshire Hathaway beginning in the early 1990s. Today, Berkshire Hathaway owns a substantial 21.3% stake in American Express, making it the holding company’s second-largest stock position, surpassed only by Apple.

Here’s why this financial services stock should fit comfortably into most portfolios.

A brand that commands respect

American Express’ legacy dates back to 1850, weathering countless economic storms along the way. The company’s name has become synonymous with quality, prestige, and trust.

This powerful brand recognition translates into a loyal customer base, particularly among high-value clients who appreciate the perks and benefits offered by American Express’s premium card products.

The company’s resilience through various market cycles demonstrates the strength of its brand and business model. American Express has consistently adapted to changing consumer preferences and technological advancements, maintaining its position as a leader in the financial services industry.

A unique business model in the financial sector

Unlike its competitors Visa and Mastercard, American Express operates as both a payment network and a card issuer. This dual role allows the company to collect fees from merchants and earn interest income from cardholders. The model provides American Express with greater control over pricing, risk management, and cross-selling opportunities.

This unique positioning also gives American Express an important competitive edge. Namely, the company can tailor its offerings to meet the specific needs of both merchants and consumers, creating a more integrated and valuable ecosystem for all parties involved.

Consistent growth and shareholder rewards

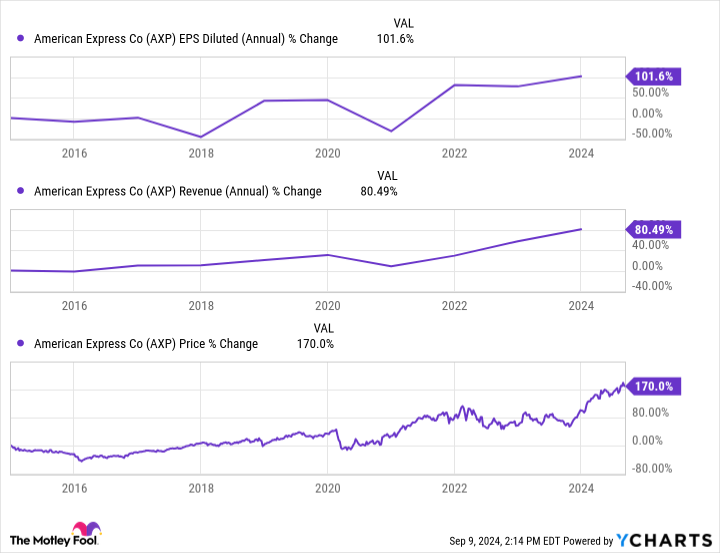

Over the past decade, American Express has demonstrated its remarkable ability to grow revenue and earnings consistently (see graph below). The company has navigated enormous challenges such as increased competition and regulatory changes, while maintaining its upward trajectory. This resilience speaks volumes about the strength of American Express’s business model and management team.

American Express’s commitment to shareholder value is evident in its aggressive share buyback program and steadily growing dividend. The company has reduced its outstanding share count by approximately 30% over the past decade, effectively ramping up earnings per share and the dividend growth rate.

While the current dividend yield of 1.15% may seem modest, it’s highly sustainable with a payout ratio of just 19.4%. Dividend sustainability is crucial to building an income snowball over time and American Express sports a highly reliable cash distribution.

Moreover, American Express has increased its dividend by an incredible 10.4%, on average, per year over the past ten years. In fact, this is one of the highest dividend growth rates among the whole of large-cap equities.

This combination of share buybacks and robust dividend growth exemplifies the compounding effect that Buffett seeks in his investments and offers investors a potentially growing income stream.

Why most investors should consider American Express

American Express offers investors a compelling combination of brand strength, a unique business model, and shareholder-friendly policies. The financial services titan is also in a prime position to capitalize on the ongoing shift toward digital payments.

Perhaps most importantly, the company’s ultra-low payout ratio leaves ample room for additional increases to its quarterly cash distributions. Meanwhile, its entrenched market position and unique business model provide a solid foundation for long-term capital appreciation.

Should you invest $1,000 in American Express right now?

Before you buy stock in American Express, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and American Express wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,404!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 9, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. George Budwell has positions in Apple. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, Mastercard, and Visa. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

1 Warren Buffett Dividend Growth Stock That Deserves a Spot in Your Portfolio was originally published by The Motley Fool

Credit: Source link