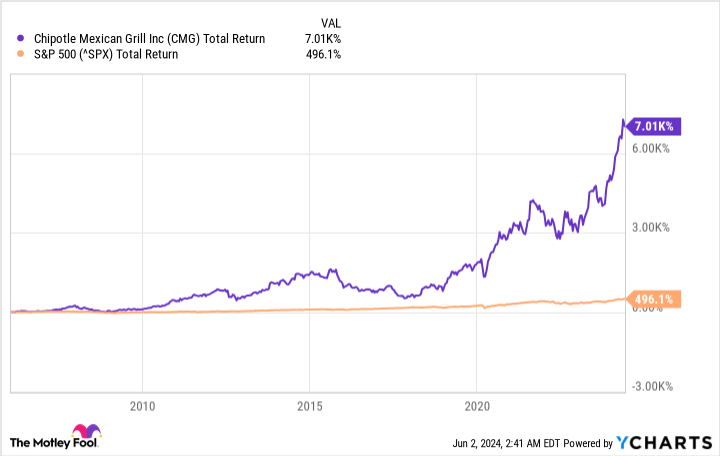

Over the long term, the stock market has been an incredible wealth-building machine for patient investors. For example, if you had invested $1,000 in the S&P 500 in 2006 and reinvested your dividends along the way, you’d have a stake worth about $6,000 today, an annualized return of 10.6%.

That’s a safe way to grow your money. But if you had invested in some individual stocks as well, you might have a lot more. That’s the beauty of a diversified portfolio. If one stock plummets, you can only lose the amount you put into it. But an investment that takes off can double or triple your money or gain even more, making up for the investments that go sour.

Growth investors can reap huge rewards over long periods of time. If you had invested $1,000 in Chipotle Mexican Grill (NYSE: CMG) stock in January 2006 when it went public, you’d have a stake worth about $71,000 today.

What Chipotle is doing right

Chipotle launched the fast-casual restaurant concept that has become part of American culture, and it’s still a dominant force in that niche. Many chains have tried to replicate its success, some faring better than others, but none have achieved what Chipotle has. CEO Brian Niccol said on the recent earnings call, “I believe the next Chipotle is Chipotle.”

Customers love its fresh and healthy food at mid-range prices. The concept is popular among a more affluent demographic where spending remains resilient despite inflation, and who are still springing for fast-casual even if they’re cutting down a bit on luxuries.

Chipotle has been through some difficult times, including several scandals and food-safety issues. Its stock hasn’t always been a reliable grower. But since the company got a new CEO in 2018, it has fixed itself up and gone on an incredible run. It’s an illustration of why identifying stocks with strong potential and then holding on for the long term is such a wise strategy.

Chipotle fairly consistently reports double-digit percentage revenue growth and strong comparable sales growth, as well as expanding margins and increasing profits. In 2024’s first quarter, revenue increased 14% year over year, driven by a 7% increase in comparable sales. Operating margin widened from 15.5% to 16.3%, and earnings per share rose from $10.50 to $13.01.

There’s still a massive opportunity

Niccol explained that Chipotle has made major improvements in its processes that are leading to quicker service. Between that and some marketing campaigns, transactions jumped 5% in the first quarter, driving the higher comps result. As well as Chipotle is performing, it’s still finding ways to improve.

Chipotle has already proven its concept and grown its business, and it’s now expanding even further. Though it already has almost 3,500 stores, it sees the opportunity to grow that number to 7,000. It has moved beyond the urban centers where it’s well established and is opening stores in more suburban areas, as well as in foreign markets. It’s making more of a push into Canada, and it recently signed its first franchise agreement for stores in the Middle East.

Chipotle opened 47 new locations in the first quarter and plans to open about 300 during the full year.

How does the stock split play in?

Chipotle announced this month’s 50-for-1 stock split in March. That’s one of the largest stock-split multiples ever. Chipotle shares have a four-digit price tag, and companies often split their stocks when the price gets very high, since some investors may view that as a barrier to entry — even in a time when most brokerages offer their clients the option of buying fractional shares. Stock splits don’t change anything fundamental about a company — they just divide its shares into smaller pieces — but investors love them. And when a stock price gets high enough to justify a split, it usually indicates that the company is doing well, and the decision to conduct one signals that management expects the good times to continue.

Chipotle’s market cap is up 34% so far this year, and investors can expect that to increase with the stock split. Long term, Chipotle is a winning stock that could add value to any retail investor’s portfolio.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before you buy stock in Chipotle Mexican Grill, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 3, 2024

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

1 Unstoppable Stock-Split Stock That Turned $1,000 Into $71,000 was originally published by The Motley Fool

Credit: Source link