With artificial intelligence (AI) getting installed in big-tech data centers at a rapid pace, the investment world has begun fretting over a new set of related problems: higher energy consumption. The semiconductor systems used to power AI — like those from Nvidia — consume copious amounts of energy, so much so that expectations for global power demand are rapidly rising.

Nvidia isn’t worried. It has an ecosystem of engineering partners hard at work solving energy delivery and other related data center problems. One such partner that got a name drop from CEO Jensen Huang earlier in 2024 is Vertiv Holdings (NYSE: VRT). The stock could be a buy, if only the price was right.

Vertiv holds a key position in engineering data centers

Up until just recently, Vertiv has been a pretty boring industrial energy engineering business. It was spun off from Emerson Electric and sold to private equity in 2016. Then in 2020, the name was changed to Vertiv and the company was taken public via a special purpose acquisition company (SPAC).

Following that, shares didn’t do much to write home about — at least, not until 2023, when investors started to get wind of Vertiv’s potential in data center applications. And then in March 2024, during Nvidia’s annual weeklong GPU Technology Conference, it was announced that Vertiv was entering the Nvidia Partner Network. That relationship really electrified the stock price.

Speaking of electrification, Vertiv engineers and manufactures power delivery and management systems for data center servers (the computing units that sit in pull-out drawers in data center racks).

As with all electrical systems, more energy use means more heat, a harmful side effect of powerful new AI servers. Vertiv engineers the cooling systems, too. Being added as one of Nvidia’s key consultants in power and cooling systems obviously has investor optimism flying high, given how fast Nvidia is growing.

Vertiv itself seems more than happy to tout its integration into Nvidia’s ecosystem. As AI radically alters the way data centers are operated, the company thinks it has a new growth tailwind at its back. Management said its backlog of equipment and service orders increased 15% to $6.3 billion in just a three-month period from the end of 2023 to the end of the first quarter of 2024.

A valuable supply chain partner, but how valuable?

Vertiv’s stock advance is impressive to behold, but I have concerns that the valuation now outstrips present reality. At a market cap of over $36 billion after the recent run-up, the stock is valued for nearly 40 times expected 2024 earnings per share (EPS).

To be clear, this isn’t the most egregious valuation being bandied about in the AI investing fervor. However, Vertiv expects organic revenue growth (excluding acquisitions and divestitures) to increase about 12% this year.

Growth from the data center AI boom looks priced-in already, unless management is seriously underestimating actual revenue. Maybe some of that $6.3 billion backlog will turn into sales sooner rather than later.

At this point, Vertiv is indeed an interesting business that could be a long-term winner from the AI race. It seems to have secured itself a position in the data center supply chain, and especially for AI being fueled by Nvidia. Perhaps Vertiv’s growth story will be longer-lasting than just the recent hype.

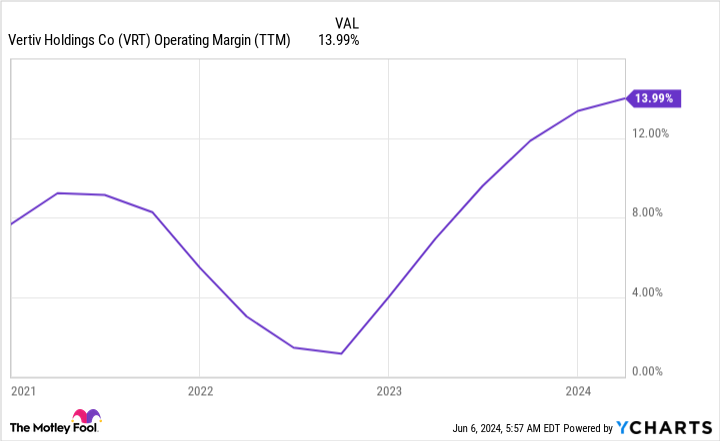

But for an equipment engineer with its fate as a premium-priced stock largely tied to the innovation of Nvidia, the current valuation is a bit steep for my taste. Vertiv won’t just need to grow, but its profit margins (operating margin of 14% over the last 12-month stretch) will also need to expand to justify the stock run-up.

For now, Vertiv is on my watch list, but nothing more. If shares cool off a bit, this one might be worth revisiting.

Should you invest $1,000 in Vertiv right now?

Before you buy stock in Vertiv, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vertiv wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 3, 2024

Nicholas Rossolillo has positions in Nvidia. The Motley Fool has positions in and recommends Emerson Electric and Nvidia. The Motley Fool has a disclosure policy.

1 Hot Data Center Stock to Buy — If It Ever Cools Off was originally published by The Motley Fool

Credit: Source link